Are you looking for a cheap and easy way to do your individual tax return this year? If so, then online tax return services are the way to go!

In this blog post, we will share with you the top 30 cheapest individual tax returns online in Australia. So without further ado, let's get started!

Ultimate List Of Cheap Individual Tax Returns Online in Australia

Tax Warehouse - Cheap Individual Tax Returns Online Australia

0407 418 209

You Can Trust Online Tax Accountants in Australia

Do you hate filing your taxes year after year? Then, you don't have to anymore! We make submitting your tax return easier than ever at Tax Warehouse because we do it for you!

Our service is quick and easy to use, allowing you to choose a professional tax agent online and get your tax refund filled and processed as soon as possible, all while using your smartphone.

Tax Warehouse's tax professionals will file your tax return for you online.

Their track record of claiming the greatest deductions and obtaining the highest tax refund feasible in your industry. We give you peace of mind by ensuring that properly qualified and licensed tax agents handle your return. As a result, we maximise your return amounts while minimising your effort, so you don't have to dread tax season and can put your tax refund money to work sooner!

To learn more about how our qualified online tax accountants can assist you, contact us immediately at 0407 418 209 or director@taxwarehouse.com.au.

A qualified tax professional can help you file your 2022 tax return online.

In minutes, you may complete your application.

*Pay nothing upfront.

- Maximum reimbursement

- Receipts are required to prove your tax deductions.

- Our friendly team will verify your identity via video.

What can you anticipate from our online tax agent services?

Our online tax guidance is tailored to you, no matter who you are or what industry you work in. Contractors and individuals in the building and trades industries, corporate and creative professionals, retail personnel, agricultural labourers, school teachers, office workers, social workers, and anybody else who is obliged to register an Australian Tax Return are all served by us. Our online tax accountants can help you maximise your return whether you're in Adelaide, Mildura, Melbourne, Sydney, Brisbane, Perth, Darwin, Gold Coast, Cairns, Townsville, Hobart, Shepparton, Swan Hill, Portland, Sale, Toowoomba, Broome, or anywhere else in Australia. In addition, the tax Warehouse knows what tax deductions you can claim. This ensures that you receive a fantastic tax refund each year.

Expert guidance and assistance

Our representatives are tax experts, so you don't have to be. However, any inquiries you may have regarding maximising your tax refund can be answered by us.

Money well spent

There are no hidden fees, and our prices are tax-deductible. So, for example, you can pay $121 upfront or deduct $143 from your tax return.

Finish in minutes

Your tax return does not have to be a lengthy procedure. With our online tax return service, you may complete our simple steps in minutes. Mildura to Adelaide, Hobart to Darwin, Perth to Brisbane, and everything.

Quick turnaround

There's no need to hold your breath. Within 10 to 14 days, your tax return will be deposited into your bank account. Our process is quick and easy, just like your tax return should be.

Maximum reimbursement

On your tax return, we guarantee a maximum refund. Our tax professionals will examine your sector to guarantee you've claimed all possible deductions. You must be able to provide receipts or invoices to back up your claim.

The online procedure is simple.

There aren't many complicated questions on our list. Our online application is straightforward and takes only a few minutes to complete. Fill out our online tax return form at www.taxwarehouse.com.au/get-refund/ and leave the rest to Tax Warehouse.

Tax Window - Cheap Individual Tax Returns Online Australia

0401 117 311

Tax Window employs an award-winning approach to taxation, setting them apart from typical accounting firms. Their comprehensive services extend beyond the scope of traditional tax agents, offering expertise in various financial areas such as investment accounting and business enhancement.

Unlike many tax agents who charge exorbitant fees for their services, Tax Window takes a different approach. They believe in simplifying the taxation process, providing clients with understandable solutions that are tailored to their specific needs. Moreover, Tax Window stands out by offering industry-leading fees for its exceptional services.

One of the key aspects of Tax Window's service is its focus on delivering personalised tax strategies to each client. As a boutique tax practice, their team of tax agents pays special attention to individual clients, ensuring that their tax strategies are carefully crafted to minimise tax payments.

For those seeking investment planning assistance, Tax Window is a reliable partner. They possess unique insights into the Australian tax code, allowing them to develop strategies that keep their clients ahead in the financial game.

Business owners can also benefit significantly from Tax Window's expertise. The team understands the challenges of managing a business and the burden of compliance-related tasks. By entrusting Tax Window with their accounting and taxation needs, entrepreneurs can free themselves from the hassle of number crunching and focus on the growth and success of their ventures.

Tax Window's award-winning approach to taxation goes beyond the norm, offering exceptional services that cater to the diverse financial needs of its clients. Their dedication to providing understandable solutions at competitive fees sets them apart as a reliable and trusted partner in the complex world of taxation and financial management.

BC Accountants - Cheap Individual Tax Returns Online Australia

Welcome

Fast online tax returns, financials, counselling, and other services for businesses and individuals. Experts have been charging the lowest flat costs for over 25 years. Simply choose your form below and enter or upload your information online.

Our procedure

As soon as you submit our online form, we get to work.

Then, for individual returns, we;

- If additional information is required, we will contact you.

- Examine your ATO pre-fill reports, system balances, and status.

- create a copy of the return and email it to you

- Unless we hear from you, please lodge by the next morning.

We will; for business returns

- If additional information is required, we will contact you.

- Check your ATO balances, status, and previous refunds.

- any other modifications and duties that may be required

- To assure accounting and tax compliance, generate reports or financials.

- Prepare returns and send them all to be reviewed and signed.

- lodge online as soon as we have signed copies

We'll do the following for SMSF returns:

- If additional information is required, we will contact you.

- Check your ATO balances, status, and previous refunds.

- Data entry, updates, reconciliations, and modifications are all things that must be attended to. prepare financials, minutes, and paperwork returns

- all to you for evaluation and signature

- complete the independent SMSF audit and submits it online

- ATO confirmation, payment advice, and audit report will be sent.

Q-Tax - Cheap Individual Tax Returns Online Australia

1300 047 845

Why should you choose QTAX Virtual?

There's no need to go to the office.

A tax specialist prepares your tax return.

- Increase your deductions.

- Convenience and ease

- Direct deposit and electronic filing

- Secure and safe filing

- Simple taxation

Returns of Students

We'll handle your tax return if you're a high school student (under 18 years old). Our tax advisers are sharpening their pencils to help you get the best potential tax refund for only $69 for your first tax return. You may be eligible for a tax refund if you work part-time and do fruit harvesting or hospitality/retail labour.

Your Return and Beyond We don't just park and forget about it. Of course, we shine during tax season, but we're also available throughout the year to assist students with issues such as understanding the tax consequences of part-time work.

While you're learning new things, we're putting what we've learned to work for you.

Individual Tax Returns FAQs

$18,200

If you earn more than the tax-free threshold which currently stands at $18,200, you're required to lodge a tax return.

You must lodge a tax return.

If during the past financial year your taxable income was more than $18,200 you are required to lodge a tax return.

$18,200

If you are an Australian resident taxpayer, the first $18,200 of income which you receive is tax-free. This is called the tax free threshold. If you earn less than $18,200 from all sources, you won't pay tax.

If you earn less than $10,000 per year, you don't have to file a tax return. However, you won't receive an Earned-Income Tax Credit refund unless you do file.

If you're an Australian resident, the first $18,200 you earn is tax free. This is known as the tax-free threshold. You can claim the tax-free threshold when you complete your TFN declaration with your employer. If you earn less than $18,200 for the entire financial year you generally don't have to pay any tax.

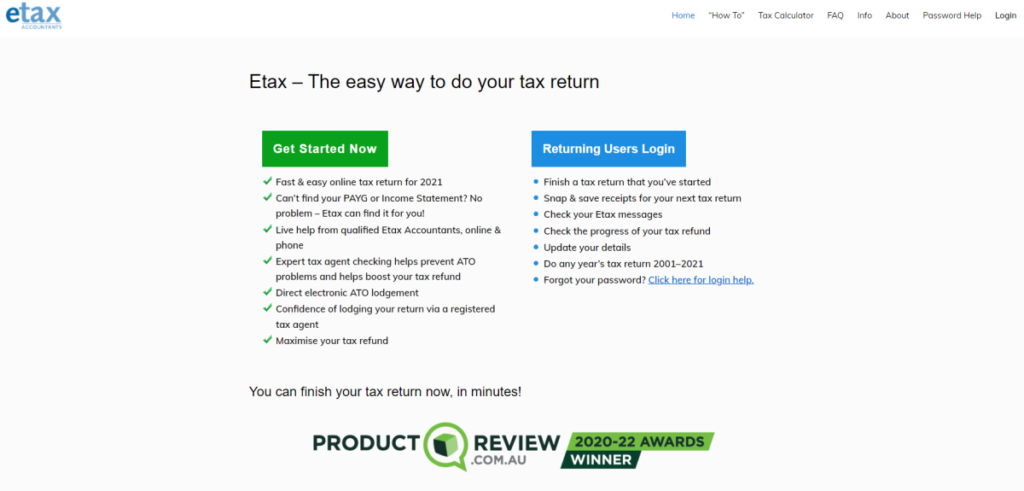

Etax Accountants - Cheap Individual Tax Returns Online Australia

1300 693 845

Why should you file your tax return with Etax?

Etax Prefill will help you with half of your tax return!

Tips for increasing your ATO tax refund

For many Australians, COVID-19 tax deductions mean higher tax refunds – To check your refund, simply start your Etax return.

Your refund will be calculated as you go.

Look at what you said last year: It helps you remember necessary deductions and saves time.

A competent accountant is available for live chat or phone support.

There are no appointments, no trips to the tax office, and low prices, yet you still get expert guidance and checking.

Less reading, more assistance

Etax Accountants double-checked for accuracy and extra deductions (better support and service than many tax agent offices)

Etax has your back. With the ATO, you don't have to go it alone.

The majority of people complete their 2022 tax return in minutes!

You can file your tax return in minutes using Etax.

How? Here are a few ways Etax may assist you in completing your tax return in minutes with the confidence that it is completed correctly.

When you need it, real qualified accountants are available to assist you.

Have a question regarding your income or tax deductions? While completing your return, you can obtain live assistance from a friendly accountant.

Most of your information can be pre-filled for you.

We can prefill much of your key information immediately from the ATO once you enter your Tax File Number, so you don't have to look it up.

Automatically saves

Your Etax return has no save button since you don't need one. It saves your progress.

Ezy Tax Back - Cheap Individual Tax Returns Online Australia

How does our procedure work? Guaranteed maximum reimbursement!

It's simple: we guarantee a maximum refund whether you sign up for a yearly, one-time, or our rapid online tax return lodgement service. Our CPA accountants will process your return once you've submitted your form. They'll double-check your information and ask questions to ensure we're getting the most out of your legal tax deductions.

It's now easier than ever to file a tax refund.

We've built an easy-to-use tax refund tool to get you started. Our online tax refund calculator for Australians is completely free.

It gives you an estimate of your tax refund right now! No credit card or registration is necessary. You have to fill out the form, and you'll have your estimate right away. This tool provides you with a quick and easy view of your possible return. So, if you work in Australia and are needed to file a tax return, we can assist you. You can sign up now or after you've finished your tax estimate.

After you submit your initial online tax return, our team will work with you to ensure you haven't overlooked any deductions.

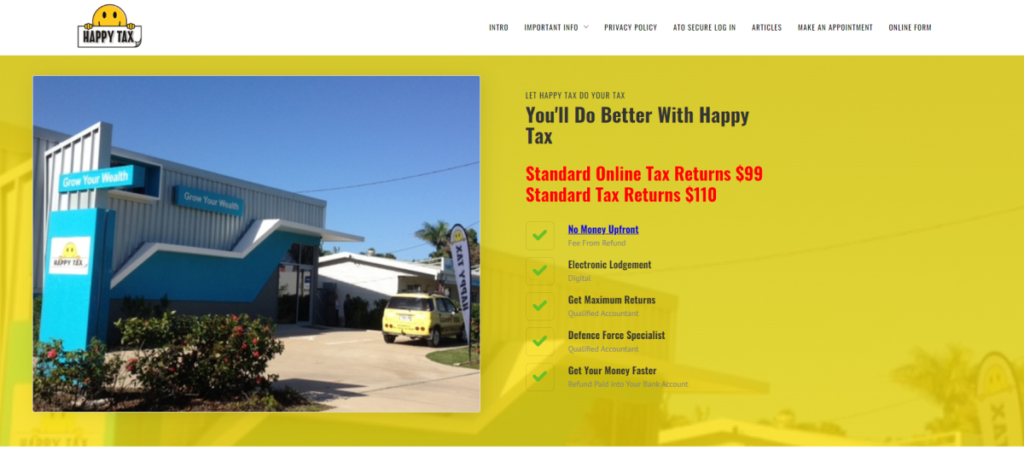

Happy Tax - Cheap Individual Tax Returns Online Australia

07 4755 1145

With Happy Tax, you'll do better.

$99 for standard online tax returns

$110 for standard tax returns

There is no money upfront.

- Fee de la restitution

- Electronic Submission

- Digital

- Maximise Your Profits

- Accountant with experience

- Specialist in Defense Forces

- Accountant with experience

- Get Your Cash Quicker

- Your Refund Has Been Deposited Into Your Bank Account

What to Bring to Your Consultation

- Statements of earnings or PAYG payment summaries (group certificates)

- List of government payments (e.g. pension, Austudy, Newstart allowance etc.)

- Dividends and interest income

- Income from managed funds, business income, partnership income, rental income, or capital gains are examples of other sources of income.

- Receipts or details of deductions for work

- Details about the dependent spouse and children

- Spouse income is used to calculate the Medicare levy surcharge.

- Statement from a private health fund

- Statements of HECS and financial supplement loans

- Letter confirming child care benefits and authorised child care charges

- Last year's tax return and notice of assessment (if available)

If you want your refund to be deposited into your bank account, you'll need the account number and BSB.

Tax Return - Cheap Individual Tax Returns Online Australia

0499 829 845

Australia's Tax Guides

TaxReturn.com.au strives to assist Australians in understanding the country's tax structure. We feel that everyone should know its nuances to make tax season less stressful and avoid certain mistakes.

Business Number in Australia

Whether you're a new blossoming freelancer looking for advice on how to get your ABN or an experienced single trader, our ABN Guide will provide you with all of the necessary information.

We want to assist you because we understand how difficult it is to run your own business. We'll walk you through obtaining an ABN, as well as expense claims, filing taxes, and more.

These suggestions will make your tax return less stressful, but they will also make your finances easier to handle and manage over time.

This TaxReturn.com.au tutorial contains everything you need to make your claims process simple for your Australian Business Number and tax.

Taxes and Young Families

Having a young family might complicate your financial condition by increasing your spending and changing your taxes. TaxReturn.com.au recognises how complicated the tax world can be for a working family, so we've put up this helpful advice.

We’ll let you know what a taxable family income is, what advantages are available and if you’re qualified for government payments, and many other tax suggestions to aid you and your family.

We all want to spend more time with our families, so we want to assist you in making tax preparation as simple as possible, so you can spend less time crunching numbers and more time with the people who matter to you.

Taxes & Working Holidays

Travelling may be costly, so many backpackers work while in Australia, but many are unaware that they can claim back tax.

Due to a lack of information, many people who work while on vacation frequently fall below the tax levels, and even fewer people try to claim that money back. TaxReturn.com.au wants to assist you in recovering your hard-earned money.

We'll also go over visa regulations and the ideal visa for you based on your travel and job intentions in Australia.

Working vacation visa holders can find everything they need to know about their tax rights in Australia in our guide. As a result, you may relax and enjoy your stay in Australia.

Tax Reform in 2019-2020

Your income, personal, or business tax may alter each year, which can be quite complex, especially if you're new to submitting your tax return.

We want to make things easy for you, so we've put up a comprehensive reference to all of the major tax changes for the 2019-2020 tax year to get the most return possible.

This comprehensive guide will walk you through various recent developments, such as tax cuts, the Medicare levy, superannuation, and more.

Cst Tax - Cheap Individual Tax Returns Online Australia

61 2 8920 0045

RETURNS OF PERSONAL TAXES

When preparing personal tax returns, individuals with overseas interests demand specialised international tax skills. You must make accurate declarations and understand your responsibilities.

We specialise in producing personal tax returns for Australians living in other countries, ex-pats in Australia, and Australians with assets in other countries.

Individuals with worldwide interests demand specialised tax skills when preparing their tax returns.

Our accounting team includes foreign tax experts who have the knowledge and experience to manage even the most complicated international tax issues.

WHO ARE WE ABLE TO HELP WITH PERSONAL TAX RETURNS?

AUSTRALIANS ON THE MOVE

Australians residing overseas with assets and investments in Australia must ensure that their tax obligations in Australia are met. We help by ensuring that your annual compliance needs are met.

EXPATRIATES IN AUSTRALIAN

We help ex-pats in Australia with overseas assets manage their tax requirements in Australia. So, for example, clients having assets in the United States, the United Kingdom, or Singapore can benefit from our integrated tax services by becoming clients of our offices in those countries.

FOREIGN ASSETS IN AUSTRALIA

Australians with assets in other countries will face special tax responsibilities. We assist by offering international tax expertise to ensure compliance with these requirements.

Xero - Cheap Individual Tax Returns Online Australia

Prepare tax returns for all of your clients.

Your practice's only software requirement is Xero Tax, which you can use for all of your clients.

Clients are not required to use Xero for their accounting.

Individuals, corporations, partnerships, trusts, and self-managed superannuation accounts must all file tax returns.

Business activity statements are included in the lodge statements and schedules (BAS)

The lodge is back up.

From 2014 forward, use Xero Tax to create and lodge all sorts of returns.

- Each year, tax forms are revised, and new ones are added.

- Xero Tax forms and schedules can be electronically lodged.

- Each month, you can file up to 1000 tax returns.

Data exchange with the ATO

- Work more efficiently with a secure data exchange between your office and the ATO.

- Prefill activity statements with data from the ATO automatically or manually.

- Prefill individual tax returns with clients' income and deductions automatically.

- Send the ATO client updates.

The Kalculators - Cheap Individual Tax Returns Online Australia

(08) 7480 2545

We Provide Much More Than Just Low-Cost Tax Returns.

The Kalculators are the accountants that Adelaide residents trust, not only for tax purposes. We have a staff of highly qualified and experienced accountants who can assist you with various personal and company accounting needs. The $60 tax returns are just the start...

- Industry-Specific Qualifications in Australia

- South Australia has 7+ offices.

- For over eight years, Adelaide's top tax accountants have been trusted.

- Ten working days for a tax refund

- You can pay in advance or with your tax refund.

TAX ACCOUNTANTS & TAX AGENTS IN ADELAIDE MAKE TAX RETURNS EASY

We make tax preparation simple. We can help you recover control of your individual or business tax returns for as little as $60. Then, after you schedule a consultation at one of our seven convenient South Australian locations, we'll take care of the rest. There are no complex forms to fill out. Only the biggest refunds.

Low-cost tax returns Residents in Adelaide may rely on

The Kalculators are well-known in Adelaide for offering low-cost tax returns. We can help you take control of your personal, trust, or business tax returns – even delayed tax returns – for as little as $60.

We make tax preparation simple. Our team of expert tax accountants can assist you in registering your business tax returns and better comprehending your past and future individual tax implications in a complex environment with constant legislative changes. In addition, we assist our clients with polite, straightforward, and brief tax discussions and make proactive suggestions to better their financial status.

Taxopia - Cheap Individual Tax Returns Online Australia

1300 829 674

Registered Tax Agents and Professional Accountants

The Taxopia team has over 40 years of experience in professional corporate accounting and consultancy services. We are a forward-thinking accounting business with full public practice accreditation and registered tax agents and ASIC agents. We've written tax and business articles for publications like the Australian Financial Review, BRW, and the Flying Solo Small Business Forum. Thousands of business tax returns, business activity statements, company tax returns, and trust tax returns have been filed with us. Our solutions are of the highest quality and offer unbeatable value to Australian small and microbusinesses.

Based in Melbourne, we provide services throughout Australia.

Taxopia is a modern online accounting service based in Mount Waverley, Melbourne. We use cutting-edge technology to keep your sensitive company or trust tax information secure and private. So whether your company is headquartered in Brisbane, Sydney, Perth, Adelaide, Melbourne, or anywhere in between, Taxopia has a superb tax accountant solution for you.

- Income Tax Return for a Corporation or a Trust

- Taxopia's Standard Company or Trust Tax Returns ($800+ GST) are now available.

- Includes tax return preparation and filing.

- You may be eligible for tax extensions if we act as your tax agent.

- Complete financial statements preparation (for bank use)

Dedicated accountant tax consultant assistance with tax minimisation and tax situation for the tax year(s) for which the service is being offered.

Size of business and record-keeping requirements apply*

Conditions apply. Please note that the following services are not included in the normal pricing; however, they can be offered at an additional cost.

- Businesses having annual revenues of more than $1 million are excluded.

- Capital Gains Tax events are not included.

- Trading in stocks is not included.

- Companies with outstanding Director(s) or Shareholder(s) loans are excluded. (7a Division)

- Fixing bookkeeping problems is not included.

- Fixing GST mistakes is not included.

- Reconciliations of asset financing schedules above two are not included. (Includes up to two asset finance schedules)

- All record-keeping software save Xero excludes year-end adjustment entries to align your bookkeeping statistics to the financial statements.

- Support from an Accountant Tax Adviser for other tax years is not included. This assistance with tax minimisation and tax situation is only available for the tax year(s) for which the service is offered.

Burford - Cheap Individual Tax Returns Online Australia

08 8271 4045

Accountant, Tax Agent, and Business Advisor in Adelaide

At Personalised Tax Services, we are dedicated to providing personal and easy-to-understand tax and business assistance at reasonable pricing.

We will meet or surpass your expectations in terms of service. We will approach your case with professionalism, efficiency, and empathy. Regardless of how complicated your return is, how old it is, or how good or awful you feel about your condition, we will assist you.

Do you require assistance with your tax return?

We create and file tax returns for you.

Individuals, businesses, partnerships, corporations, and trusts all have returns that we prepare and file. Do you need to file multiple tax returns? There are none. Non-Resident or Ex-Pat? We can assist you. Issues with rental properties, managed funds, or CGT? We can also assist with these. We can make tax time less taxing for you, no matter how simple or complex your return is.

Numberwise - Cheap Individual Tax Returns Online Australia

1300 936 656

Numberwise is your success partner.

Numberwise offers businesses and individuals full accounting solutions. It's simple to see why we're the accounting partner of choice with our specialised, personal, client-centric approach, competent employees, and over thirty years of experience. We put our clients first in everything we do, and we can show you how. Please contact us to learn more about the benefits of partnering with numberwise.

The Tax Masters

Numberwise is your success partner.

Contact a numberwise tax expert; we have a team of seasoned tax experts who will take the time to learn about your personal or business needs and objectives.

We start by getting to know our clients; our relationship with them is built on an in-depth discovery approach that allows for proactive and progressive tax planning. Then, we provide year-round tax preparation that considers your business and personal objectives. This allows key decisions to be made to support your aims in real time. Our goal is to spot possible problems early and adapt to avoid unpleasant shocks come tax season.

Numberwise knows the complexities of personal and company taxes and how they affect your financial well-being when tax laws change, and circumstances change. We look at the big picture and offer solutions to help you achieve your financial objectives. The tax specialists at numberwise are ready to help; call today for a free consultation on how we use numbers wisely.

We'll use your numbers wisely.

Our top goal is your peace of mind, knowing that your personal or business finances are in good hands. numberwise has a team of professionals with combined expertise of over thirty years. We help you with your accounting needs, whether you are a major corporation, a small business, a sole trader, or require personal tax services.

Hrblock - Cheap Individual Tax Returns Online Australia

13 23 54

Your Tax Return

We specialise in making tax returns as straightforward as possible. We offer a handy choice for you no matter when, where, or how you want to do it because we have been Australia's leading taxes professionals for over 50 years and have over 400 offices.

Tax Effective - Cheap Individual Tax Returns Online Australia

1300 399 845

Have your tax returns prepared by an expert tax accountant online without leaving your house.

Our tax accountants meet with you via online video consultation at your convenience.

Get the biggest tax refund possible and strategic tax advice that could save you tens of thousands of dollars in taxes each year.

Why should you hire Tax Effective Accountants over the internet?

We get it. Every day, you have a hundred things to do, and for whatever reason, you can't get to your accountant's office to file your tax return.

We've got you covered at Tax Effective Accountants.

Combine the peace of mind of having a professional handle your tax return with the convenience of not having to go to the office. Whether you're at home, at work, or on the go, we'll take care of everything.

Tax Planning Techniques

Discover effective tax tactics and tax structures for lowering your taxes, increasing your cash flow, and increasing your wealth.

Your company's vision. Our knowledge.

Tax Effective, Sydney's best small- to mid-sized business accountants and tax experts, can help you simplify your accounting, enhance after-tax cash flow, and achieve your business goals.

Sydney CBD Premium Tax Returns

Are you seeking an accountant that can help you maximise your tax return and give you tried-and-true solutions for legally and considerably lowering your tax bill? Tax Effective is Sydney's most popular tax return preparation service.

Learn about the advantages of a self-managed super fund.

With a self-managed super fund, you can take control of your money and plan for your retirement.

A1 Accountants - Cheap Individual Tax Returns Online Australia

03-86091845

MELBOURNE TAX ACCOUNTANT

We are a group of tax accountants with extensive experience in personal tax accounting and commercial tax accounting in various industries. Our tax accountants and consultants have degrees from Australian universities and are driven and eager to assist you with your tax issues. They are subjected to intensive and ongoing training to stay current with regulations and client requirements. We are Xero and Quickbooks expert tax accountants in Melbourne as a team.

TAX RETURNS ONLINE IN MELBOURNE & ACROSS AUSTRALIA:

Accountants and tax agents may now collect and prefill most elements of the Australian tax return thanks to the ATO's improved data matching methods. Data from the Australian Taxation Office, banks, Centrelink, education providers, service providers, share trading platform users, and information from other government and non-government entities have made this possible. Thanks to technological advancements and easy access to information, online tax returns have become considerably easier to complete than in the past. Not only do we require very little information from you, but you and your accountant might be located anywhere in Australia to assist with the filing of your tax returns.

The Melbourne office of A One Accountants lodges several tax returns by connecting with our clients via correspondence. This is the link to our online tax preparation service.

You have to fill out the form below to authorise us to act on your behalf.

Beyond Accountancy - Cheap Individual Tax Returns Online Australia

1300 823 045

A pleasant accountant who collaborates with you

We work with you to figure out how to simplify your tax issues and make proactive suggestions to help you better your situation.

Simple and practical

We understand that taxes may be a pain. Therefore we provide flexible appointment hours and one-of-a-kind online consultations.

Correct Advice

Helpful advice should not be overlooked. We make proactive suggestions to help you better your financial status.

Specialist Information

Our domain is tax rules, not yours. We keep you updated about what you need to know and when you need to know it.

With the competent tax return services Melbourne residents rely on, you can relax about your taxes.

Unlike many Melbourne tax accountants, we do more than just prepare tax returns. We go above and beyond to develop strategic tax solutions to enhance your financial situation and ensure that you get the most out of your tax return. We never cut corners; instead, we streamline our operations to give our tax return accountants more time to provide expert, value-added guidance.

Beyond Accountancy believes that every tax return should include useful, qualified tax advice; thus, our experienced accountants will look for methods to improve your financial status when completing your return. We'll keep you informed about all you need to know about taxes and provide you advice on how to improve your tax situation, pay the proper amount of tax, and get the best possible tax return.

Universal Taxation - Cheap Individual Tax Returns Online Australia

0433 930 755

Are you preparing for your tax return?

Do you want to get the finest tax returns in Perth? With experienced tax return specialists like Universal Taxation on your side, you can rest assured that you'll get the biggest refunds and the quickest settlements possible!

Our staff of accountants at Universal Taxation is qualified and well-known for working hard to ensure that you receive the best possible refunds every time. In addition, the firm provides the following tax services:

- Returns of Individuals and Businesses

- Returns from corporations, non-profit organisations, and other businesses

- Returns on BAS and IAS

- Advice and Consultation on Taxes

- Quick claim resolution and resolution of backlog concerns

- Audits by the ATO

We guarantee top-notch quality services for you and your company at Universal Taxation. Contact us now to learn more about how we can assist you with all of your tax filing needs in Perth.

The Advantages of Hiring a Tax Accountant include:

- Prepare your future tax returns quickly and efficiently.

- Make any necessary deductions.

- Accounting-based claim method with no risk of audits

- Refund claims are simple and rewarding when they are applicable.

- To protect you from inappropriate inquiries, you must be well-versed in ATO rules and policies.

- Failure to file tax returns on time can result in penalties.

A failure to lodge (FTL) on time penalty is imposed when a return or statement is not filed within a certain time.

The FTL penalty for a small entity is one penalty unit ($210) for every 28 days the filing is late, with a maximum of five units ($1050).

When a company's turnover is between $1 million and $20 million, the penalty is doubled. When assessable income surpasses $20 million, large entities must pay five times the amount. FTL penalties are applied to all returns and statements, including activity statements, income tax returns, PAYG withholding annual reports, payment annual reports, and the like, using an automated penalty system. Penalties are enforced manually in cases of escalating non-compliance.

The tax-free threshold in Australia

The tax threshold for Australian residents is $18,200 per year.

When there are multiple jobs, the threshold should be claimed from the payer who offers the highest compensation. After that, your second employer can withhold tax at the 'no tax-free threshold' rate.

The Tax Shop - Cheap Individual Tax Returns Online Australia

1300 131 945

Our Providers

Professional tax guidance

Throughout the year, prompt assistance with all of your tax questions.

You are our first concern.

We provide you with the best service available to match your specific requirements.

Complete electronic filing

Scanning of all your tax documents, allowing instant access all year.

Audit Protection Insurance

If the taxman comes knocking, you'll have peace of mind.

One Stop Tax - Cheap Individual Tax Returns Online Australia

(02) 8373 5945

Taxation

Our accounting firm is set up to satisfy your company's demands. We offer a wide range of services to businesses, partnerships, trusts, and individuals, ranging from self-assessment tax filings to complicated consultant assignments and strategic tax planning. Professional services are also available in the following areas:

- Tax advise for individuals, corporations, and small businesses.

- A business incorporation consultation

- Advice on reorganisation and reconstruction

- GST, FBT, PAYG, and IAS assistance

Taking full use of tax breaks and exemptions (e.g. Research & Development tax credits, various capital allowances reliefs etc.)

- Planning for international taxation

- Capital Gains Tax and Income Tax

- ATO tax audits and disputes management

Assist with compliance issues involving Self Managed Superannuation Funds.

Each Budget brings new tax legislation, and forms become more complicated. To improve compliance, the Australian Taxation Office applies harsh fines. Understanding the impact of tax legislation and working with competent tax advisers to plan accordingly is the key to managing your compliance obligations and minimising your burden.

New-Wave - Cheap Individual Tax Returns Online Australia

(07) 55041945

What is the purpose of the Tax Review?

Any company that has filed tax returns for at least one year

Business owners that believe they are overpaying taxes and would like a second opinion

Businesses that have experienced a capital gains tax event (such as the sale of an asset or the sale of a business) want to see whether there is anything they might do differently to save money.

Companies that pay payroll taxes

How much do your bookkeeper and accountant cost your company?

Consider where your company would be if it saved an extra $10,000, $20,000, $50,000, or even $100,000 in taxes each year.

You can put this money into marketing, hiring more personnel, or even increasing your compensation for your hard work over the years... You'd be able to take a major weight off your shoulders regarding financial security, and you'd finally feel like your company was moving forward.

Consider whether you are:

- Tired of sending your hard-earned money straight to the ATO's coffers? (Yes, we agree that everyone should pay their fair share of taxes, but not more than they must.)

- Are you tired of not knowing where your firm stands, how much tax you owe, or whether you're profitable?

- Are you tired of your standard DINOSAUR accountant who just contacts you once a year and offers no useful advice?

- With our 'outside the box solutions, our team of Chartered Accountants and Firm Advisors will assist you in avoiding the stress and anxiety of attempting to guess the financial status of your business.

These are the same tactics used by:

- When we checked the last two years of tax returns for a Labour Hire company, we discovered that they had overpaid $200,000 in taxes;

- When a construction company sold their business, it saved almost $88,000 in taxes;

- Allowing an electricity company to save money on rent by buying commercial property through their Super;

- Increased the sales of a beauty salon by 100-150 per cent year over year;

- Allowing a fast expanding online store to estimate cash flow and make timely decisions.

These are just a few examples of happy customers. We'd want to assist you in becoming one of them. What does your current accountant charge you? If the response is "cheap," you can bet they aren't putting in the time or effort necessary to help you reach these kinds of outcomes. You could be missing out on thousands of dollars.

Online Tax Australia - Cheap Individual Tax Returns Online Australia

(03) 9852 9045

About Us

It's no wonder that Online Tax Australia has completed over 45,000 tax returns after promising affordable, quick tax returns and the finest levels of customer care. Our top objective is to give you complete peace of mind regarding all of your tax return requirements.

Pricing and Services

The Australian Taxation Office (ATO) has made significant modifications to the review process that all tax returns go through as of 2018. Because of these developments, taxpayer now has a greater obligation than ever before to verify the accuracy of their tax return. OTA's comprehensive services provide everything you'll need to prepare and file an accurate tax return. On your behalf, our professionals enter into the ATO portal to confirm all available data, such as interest income, dividends, and government payments. In addition, we check your tax deductions to guarantee correctness and compliance with tax regulations before filing your tax return with the ATO (if necessary). Our method significantly lowers your risk of ATO adjustments, penalties, and interest.

Making Taxes Even Easier With Our Premium Pre-Fill Service

For an additional $10, you may use Online Tax Australia's Premium Pre-Fill Service to make the tax return procedure even easier and faster. Online Tax Australia will undertake the laborious work of locating and entering all required information available through the myGov portal with the help of our Premium service. PAYG, interest, dividends, Centrelink information, HECS/HELP, and more are all included. All you have to do now is add your data and tax deductions. As a result, when you use our Premium Pre-Fill Service, we make the already straightforward process of filing your tax return even easier and less stressful.

Why Should You Choose Us?

- Why does an experienced, professional tax agent check every return?

- Professional, experienced, qualified, and open accountants can answer all of your queries.

- Exclusive to OTA software that is convenient, quick, and simple to use. From your home or office convenience, you may finish your tax returns in 15 minutes.

- The fee is affordable and fixed (which is completely tax-deductible).

- Tax refunds are processed within 10 to 14 days (subject to ATO processing).

- A safe, secure, and ATO-approved website that ran smoothly.

- Try it for free. There's no obligation. There is no fee if you complete a return, but do not submit it for inspection and lodgement.

- OTA does not charge interest, late payment penalty, or subscriptions.

Tax Today - Cheap Individual Tax Returns Online Australia

1300 829 845

Tax Refunds in Minutes

How does it function?

Tax Today is the largest provider of same-day tax refunds in Australia. We are truly leading the way, with over 14 offices across Australia and online tax returns.

You may acquire a professionally prepared tax return and have your tax refund sent to you immediately at Tax Today.

This can be in the form of a cashable check or a one-hour direct transfer into your bank account.

That is why our name is Tax Today.

The majority of refunds are issued when your tax return is filed.

That's almost as quick as a cash machine.

So dial 1300-829-863 right now to be connected to your nearest branch.

For those unable to visit our offices, we provide super-fast online refunds.

Simply fill out our online form or call us, and we'll usually process your refund within 3-5 business days.

How much money will I get back?

With our free income tax calculator, you can estimate the size of your refund.

This up-to-date tax calculator is for the most recent fiscal year, which ended on June 30. This should be for the current year's tax return.

Be aware that this is merely an estimate, but it calculates in the same way the ATO calculates your refund.

Express Tax Back - Cheap Individual Tax Returns Online Australia

1800 739 739

Express Tax is a tax and DASP expert.

We have created a successful "Tax Back System" after 25 years of delivering tax back services for backpackers and working visa holders.

The tax refund method was created for backpackers, travellers, and students to ensure the largest tax refund in the shortest amount of time.

Expresstax

Australia's first tax back firm, specialising in tax refunds for backpackers, working visa holders, and international students. We are now Australia's only tax and super DASP claims specialists.

Our tax refund procedure is delightfully unorthodox and one-of-a-kind. It is founded on a thorough understanding of Australian and international tax legislation.

We've been told that we have a "WOW" factor.

Get your refund as soon as possible.

Express tax is a tax refund specialist.

- Get a free estimate on your tax refund.

- There are no upfront fees, no refunds, and tax back fees.

- There are no issues in Australia. backpackers tax

- We transfer your funds to any bank in any country.

- Docs misplaced? We collect them for no charge!

- With our simple online system, you may apply in only 5 minutes.

Express tax is safe, secure, and reliable.

- Australia's quickest tax refund service

- For your protection, we offer guaranteed refund service.

- professional association member backpackers tax

- Registered tax back agent with the Australian Taxation Office

Express tax is simple; we handle everything.

- Call 1800 739 739 or +61 2 9267 3200 for free.

- Visit us at 155 Castlereagh St, Lvl 6, Sydney.

- Fill out the form and return it to our office.

- Apply online in 5 minutes and get a tax refund.

Astro Accountants - Cheap Individual Tax Returns Online Australia

07 3180 3145

People, Planet, and Mission

We're here to help individuals live happier lives by reducing financial stress, increasing financial literacy, and making better financial decisions. This principle is at the heart of all we do. Astro's team is dedicated to assisting people in becoming better money managers, both in business and as investors. As a result, we feel that if you are financially secure, you are more inclined to assist others, pass on your knowledge, and live your best life.

Returns and advice on taxes

Taxes are one of your largest outgoings, and missing a deadline may wreak havoc on your finances. We offer strategic guidance to businesses, trusts, SMSFs, and property owners. We can assist you with reorganising your affairs to ensure you meet your ATO responsibilities, reduce risks, and lower your tax.

Our staff will keep you informed and on track to meet your deadlines. We also provide programs that save your deductions online and extract the data for simple access whenever you need it.

Isn't it past time for you to become an Astro Accountant?

- Simple application procedure

- Get started on your tax return immediately.

- Upload your files to our safe server.

- No difficulty with complicated tax affairs!

- Still, have questions? - Freephone advice is available all year.

- Upgrade today to an Astro Accountant.

Maurer Tax - Cheap Individual Tax Returns Online Australia

0438 960 945

We're unique in that we adore taxes.

RETURNS, RETURNS, RETURNS, RETURNS

- Friendly and supportive tax accountant efficiently prepares and files tax returns.

- Your tax refund will arrive sooner if you file on the same day.

- Returns for individuals, ABNs, partnerships, corporations, and trusts are all accessible.

ADVICE ON TAXATION AND PLANNING

- Sessions of consultation and assistance to answer any of your tax questions.

- ABN registration, GST registration, and company/partnership/trust formation are all examples of entity creation.

You are our principal focus at Maurer Taxation.

Don't let yourself be reduced to a number by big accountancy firms. Instead, get the tax assistance you need at a fair price from professionals who care about you.

Mulcahy & Co - Cheap Individual Tax Returns Online Australia

1300 204 745

Mulcahy & Co. welcomes you.

Mulcahy & Co is your one-stop-shop for accounting, tax, financial planning, legal, and marketing services.

We've provided specialised and personalised services to businesses, farmers, wage and salary earners, and retirees for more than two decades.

- Multiple roles are now available at our Australian offices.

- Individuals, businesses, and farms can benefit from full-service financial solutions.

- Assisting you in achieving financial stability.

Mulcahy & Co is your one-stop-shop for accounting, taxation, financial planning, legal, loans and financing, and marketing.

We've provided specialised, customised services to businesses, farms, people, and retirees for more than two decades.

East Partners - Cheap Individual Tax Returns Online Australia

(08) 8362 3445

Our Adelaide accountants can assist your company.

Accounting Automation

We use the same real-time financial data as you when accounting in the cloud.

Set You Up For Success

You may maximise tax benefits and preserve your business assets by using the proper business structure.

Keep More of Your Earnings

Nobody likes to overpay their taxes. So we assist you in maximising any tax benefits you may be entitled to, as well as planning.

Boost Your Superpowers

Our team of SMSF experts has the most up-to-date knowledge to guarantee you get the best guidance possible.

Increase Cash Flow

We'll assist you in creating cash flow budgets and predictions, so you don't get caught off guard.

Take Good Care of Your Books

Bookkeeping may be tedious, and for most of us, it is the last thing we want to do after a long day at the office.

East Partners' Contribution to Your Success

Are you fed up with battling it out in your business? Do you want to boost profitability, increase cash flow, and reclaim your life's balance? East Partners can assist you in moving your business in the right direction and increasing its profitability!

We are committed to providing you with this; We are based in Adelaide and serve clients across Australia.

- PROVIDING ACCOUNTING AND BUSINESS ADVICE IN PRACTICE

- THE BEST FINANCIAL AND ACCOUNTING TECHNOLOGY

- NO SURPRISE FEES

- ONLY EXPERT ADVICE FOR YOUR COMPANY

As a team, we work with you to increase your wealth and expand your business. In addition, we can provide you with expert financial and business guidance.

ITP Accounting Professionals - Cheap Individual Tax Returns Online Australia

1800 367 445

OUR SERVICES Tax Training

The ITP Income Tax Course may be appropriate for you if you seek a fulfilling career as a tax consultant or want to learn more about income tax.

Calculator for Taxes

What should you anticipate from your tax return? Estimate your tax refund with our tax return calculator.

Bookkeeping

We'll personalise our service to meet your needs, whether for one day or five days a week. Benefit from the expertise of individuals familiar with several industries and can provide advice tailored to your specific need.

Austax Tsv - Cheap Individual Tax Returns Online Australia

07 4725 2345

Personal Services And Individual Taxation

We make it simple for you, regardless of who you are, your industry, or your position. Our competent and experienced experts are dedicated to removing the worry about complying with your tax requirements and achieving the best possible outcome. We are the largest preparers of individual tax returns in North Queensland.

![Top 40 Epoxy Flooring & Coating Companies Melbourne, Victoria [2022]](https://mymelburnian.com.au/wp-content/uploads/MYMELB-Epoxy-Flooring-1024x683.jpg)

![50+ Best Standing Up Office Desks in Australia [2022]](https://mymelburnian.com.au/wp-content/uploads/MYMELB-Best-Standing-Up-Office-Desks-in-Australia-1024x681.jpg)