Are you looking for a Melbourne mortgage broker? If that's the case, you've arrived at the correct place. This blog post will present some of Melbourne's best mortgage brokers. We'll also offer some advice on how to select a mortgage broker. So, whether you're a first-time homebuyer or a seasoned investor, keep reading for tips on selecting the right mortgage broker. Brokers have access to various products and lenders, allowing them to get you the best offer.

We'll go over what mortgage brokers perform and why they're useful when buying a house in this piece. We'll also go over some of the disadvantages of utilising a mortgage broker so you can decide whether or not this is the best option for you.

Ultimate List Of Mortgage Brokers In Melbourne

EWM Accountants & Business Advisors - Mortgage Brokers Melbourne

03 9568 5444

About EWM Accountants & Business Advisors - Mortgage Brokers

Chartered Accountants at EWM Accountants and Business Advisors assist small businesses with accounting, bookkeeping, and taxation needs. We have been assisting small businesses for over 30 years and specialise in the construction, investment, medical, dentistry, and manufacturing industries. The firm comprises a group of skilled accountants who provide a lot of knowledge to assist us achieve our mission. It is based in Oakleigh in Melbourne.

Our Vision

To be the only accounting and taxes small company advising firm, we must assist our customers in recognising and shaping their future potential.

Our Mission

To assist families in transforming their businesses into new-age firms that will thrive in the next decade and beyond. Every day, we help our clients on their route to success †"they choose their path, and we help them. Our clients define success for themselves, and we accompany them on their path and take great pride in their accomplishments.

Our Services

Business Accounting Services

- Melbourne Business Accounting Services - We emphasise growing our clients' businesses and profits and managing the rigorous requirements of complicated compliance and regulation. Our staff of highly certified accountants, bookkeepers, and financial strategists is fully trained and experienced in implementing best practice financial management standards in Melbourne to support your accounting and processing needs. Our streamlined regulations and procedures simplify outsourcing your finance function while also providing important experience to your team and company.

Taxation Services

EWM Accountants will assist you in achieving your objectives. Offering the finest in tax administration and management necessitates flexibility, cost-effectiveness, consistency across the board, and, most significantly, the ability to comprehend your own or your company's unique needs. EWM Accountants & Business Advisors' tailored tax solutions allow you to be flexible, adapt, and make changes when and how you need to, ensuring you get the most out of your cash flow.

Our Taxation Services

- Income Tax Advisory

- Salary Packaging

- Payroll Tax

- Capital Gains Tax

- GST

- Managing Tax Risk

- Tax Planning

- Structuring

- Fringe Benefit Tax

It is possible to make valid, legal decisions that considerably influence the tax you pay, depending on your circumstances. Make sure you're claiming all of the tax breaks you're entitled to.

Resolve Finance Mortgage Brokers Melbourne

1300 883 292

About Resolve Finance Mortgage Brokers Melbourne

Because that's what we do, we're called Resolve. We're here to help home buyers, builders, renovators, and investors overcome obstacles on their way to whatever comes next.

What Are Our Identities?

We're here to help you find answers, provide options, make better decisions, and ensure that you and your family may live your best life. We're not only here to help you get a mortgage. Our team can assist you with saving, personal finance, and real estate.

Our Mortgage Consultants

We only hire the top brokers in the industry at Resolve. All members of the team are MFAA-approved and hold a Financial Services Diploma. We also give regular training and support to keep them informed about the latest goods and rules. Meet the brokers who can help you find the best home loan.

Coaches In Finance

We have a staff of Finance Coaches at Resolve Finance who can assist make house ownership a reality for those who never thought it was possible. In addition, you will have a dedicated finance coach as a My Home Plan customer who will work with you to establish a tailored budget to save for a deposit.

Management

Resolve Finance's executive team includes some of the industry's brightest thinkers in financial services. In addition, our executive team collaborates closely with the Resolve Finance team and the ABN Group to keep our company at the forefront of the Market in terms of product, service, and knowledge.

Loan Market Mortgage Broker Melbourne

13 8554 4627

About Loan Market Mortgage Brokers

- We're not a bank, and we're not owned by one. Profits drive a bank. We serve you.

- Taking care of the family. For 27 years, I've been assisting Australians and New Zealanders in achieving their objectives (and counting)

- Negotiating power. We give you choice and control with our panel of more than 60 banks and lenders.

- Keep it genuine. We speak in plain English, with no jargon!

Purchasing A Dwelling For Personal Use

There are a few things to think about before starting your house quest. Examining your budget and understanding what you can comfortably afford are two important elements in making this selection.

Buying A Rental Property As An Investment

We've explained the essential processes in property investing so you can see what's involved and how we can assist.

Home Remodelling

The amount you need to borrow, your existing loan balance, and the value of your home are the most significant elements to consider when applying for a renovation loan.

Home Loan Refinancing

Refinancing can offer you access to the equity you've built up, or it can simply save you money by combining debts or switching to a lower-cost loan.

Loans To Businesses

Loan Commercial loan specialists at Market can assist you with business expansion financing, investment capital, leasing, and purchasing.

Insurance For Real Estate

It's critical to safeguard your investment once you've made a purchase.

Automobile Financing

Rather than taking the loan your auto dealer offers, we put you in charge by assisting you in selecting the best loan from a panel of lenders.

Our Services

Access To Cutting-Edge Technology That Has Won Awards.

Manage your clients, sales, compliance, lead creation, referral alliances, and marketing from a one, easy-to-use interface. You'll be able to keep track of your commissions and payments and receive frequent business insights that will help you stay on top of cheval. Our award-winning platform, MyCRM, delivers everything you need at your fingertips to get more done in less time. It's a comprehensive business solution for brokers that streamlines operations so you can focus on creating client relationships. MyCRM is fully integrated, which means you have everything you need to operate your business in your hand. There will be no more switching platforms.

Automated Marketing And Client Retention Programmes

We understand that marketing entails more than a vibrant brand and compelling consumer communications. So we've designed automated marketing and lead creation solutions to assist our brokers in finding, converting, and keeping clients. Getting started with Loan Market is simple; our team will assist you with producing advertising, apparel, signs and public relations and social media services to help you build your brand in your region.

Join The Largest Real Estate Network In Australia.

Thanks to our exclusive cooperation with Ray White, you can generate genuine business outcomes. You have the opportunity to incorporate a Ray White referral partnership into your business as a Loan Market member. Ray White offers a network of 1,000 offices and over 13,000 members, which means you'll have more opportunities to form solid, long-term relationships. Ray White agents and property managers sent more than 22,000 leads to our brokers last year.

Your Personal Broker Success Team Will Assist You Directly.

Plan your vision and business growth strategy with the support of our Broker Success experts. They assist you in developing a customised plan and providing assistance on how to discover the perfect individuals to join your company. In addition, they'll teach you about lead generation and marketing tactics, and they'll work with you to make the most of Loan Market's resources.

As A Trusted Advisor, You'll Have More Business Opportunities.

Becoming a Trusted Adviser is a Loan Market approach for becoming a professional who links customers with a network of services and products other than mortgages. As a Loan Market broker, you can use Home Now to lower home power expenditures, offer Asset Finance, and leverage Ray White to develop referrals.

Not Brand Slaves, But Brand Champions

Loan Market's franchise and member agreements are unique in that they allow our brokers to switch aggregators while preserving full rights to their trail with just 14 days' notice. There are also no contracts that tie you in. We must consistently provide value to our members because brokers are not "tied in" to Loan Market. We see this as an opportunity to surprise you at every turn rather than a risk.

Feelings In The Loan Market

Culture is the most difficult to describe because it is more frequently a feeling than a real object. But we know we have something special at Loan Market, so when Momentum Intelligence issued the 2018, 2019 and 2020 Aggregator of Choice Report, we were delighted to learn that Loan Market ranked first in overall broker satisfaction. For the third consecutive year.

The Australian Lending & Investment Centre Melbourne

1300 254227

About The Australian Lending & Investment Centre Melbourne

Ethical Lending Concepts Pty Ltd, trading as ALIC, was established in 2009 as our firm. Our mission is to be our clients' trusted mortgage advisor, assisting them in "ethically" building wealth through investment. Thanks to our nationwide offices and lender-agnostic methodology, we've assisted investors and house buyers in over $6.389 billion in loans since 2009.

The Advantage Of Alic

As an ALIC client, you will benefit from speedier, more results-oriented, and responsive lending. We understand that loan approvals are often dependent on timing – especially in competitive markets – so we'll work with you to ensure that you get the mortgage advising services you need as soon as possible. We're also a wealth-building firm for our clients. The success of your investments defines our success. Thus our brokers do more than facilitate loans; they actively provide advice to help you maximise your profits. Don't hesitate to contact us to discover more about how the ALIC advantage can help you transform your wealth.

Our Services

Loans To Businesses

With our commercial financing solutions, you may strengthen your portfolio.

Building construction

We'll assist you in acquiring and refinancing commercial properties to increase your wealth.

Whether you're a professional investor, property developer, or SMSF investor, getting the right loan can help you make the most of your property investment. Our skilled commercial brokers can assist you in obtaining loans that result in improved returns, from improving your LVR to negotiating ideal repayment terms.

Loans for Commercial Property Investment

Our commercial brokers can assist you in obtaining finance for commercial-class property investments. Commercial investment loans are sometimes less risky than other commercial property loans, making it easier to obtain favourable lending terms. In addition, different properties and different types of investors are optimally matched with lenders and loan terms that meet their investment and business goals. Our brokers can help you discover an appropriate lender and present your case in the best possible light.

Loans for Commercial Property Development

Flexible financing alternatives are critical to the success of your business venture. Commercial developments, which usually include more than four units, have different regulations and interest rates than residential developments. Because of our significant commercial experience, we understand the complexities of development loans. Our brokers can help you borrow up to the LVR limit and secure better interest rates by properly describing your development plan and financial history.

SMSF Commercial Property Loans SPEAK TO A BROKER

Use your self-managed super fund (SMSF), a tax-efficient investment vehicle, to do your super work for you. Commercial properties often yield larger returns than residential properties, which appeals to growth-oriented SMSF investors. Commercial loans taken out through an SMSF may also be eligible for lower interest rates. Request business property financing through your SMSF from one of our brokers.

FAQs About Mortgage Brokers

Having multiple offers in hand provides leverage when negotiating with individual lenders. However, applying with too many lenders may result in score-lowering credit inquiries, and it can trigger a deluge of unwanted calls and solicitations.

It takes between 4 and 8 weeks to get a formal mortgage offer from acceptance of an offer. Ideally, you will already have chosen a mortgage lender. You will have asked the lender for a Decision in Principle (DIP).

Do you need a mortgage or agreement in principle to make an offer? In principle, a mortgage or agreement is not needed to make an offer, but having one when shopping for a house will give you a better chance of getting your offer accepted for a house, as sellers will take you more seriously.

Some lenders work exclusively with mortgage brokers, providing borrowers access to otherwise unavailable loans. In addition, brokers can get lenders to waive applications, appraisal, origination, and other fees.

It takes between 4 and 8 weeks to get a formal mortgage offer from acceptance of an offer. Ideally, you will already have chosen a mortgage lender. You will have asked the lender for a Decision in Principle (DIP).

ARG Finance - Mortgage Brokers Melbourne

1300 511 655

About ARG Finance - Mortgage Brokers Melbourne

ARG Finance is a unique boutique mortgage brokerage firm.

We are a group of highly-skilled, experienced, and financially smart experts who excel in math and can assist you with any amount or type of loan. Rakesh Gupta, the founder of ARG Finance, has extensive experience in the mortgage brokerage market, working with many lenders. He has built a strong team to pass your mortgage exam with his insightful leadership and industry connections. ARG Finance is more than simply a mortgage broker; it is a full-service financial solutions provider.

Our Services

First Home Buyer

Congratulations on taking this important step! Purchasing a first house is a desire shared by all Australians. At the same time, the route is exciting and intimidating. If you're buying your first house, don't be overwhelmed; we're here to provide you with the necessary information and assist you in selecting the right loan. We look at hundreds of loans from various lenders and work with you to discover the best loan for your specific needs and circumstances. Before looking for your dream home, you must first determine two critical factors: your borrowing capacity (how much you can borrow) and your affordability (how much you can afford to repay).

Loan For Refinancing

Are you seeking a reduced interest rate to help you pay off your debt faster? Are you thinking of buying an investment property or finally doing that makeover you've always wanted? Refinancing can be the solution you've been looking for to avoid your roadblocks. We look at hundreds of loans from various lenders and work with you to find the best loan for your specific circumstances.

Entry Finance Mortgage Brokers Melbourne

1300 468 419

About Entry Finance Mortgage Brokers Melbourne

Entry Finance sets the standard for flexible and cost-effective mortgage and finance alternatives in Australia. Our goal is to become Australia's go-to finance and mortgage broker. We offer creative, efficient, and individualised solutions to meet your needs. Our purpose is to assist you in achieving your financial objectives and securing your future. We have knowledge and experience in both mortgage and loan brokerage. This enables us to provide financing choices to assist you in achieving your financial objectives.

We believe in establishing long-term relationships by providing you with realistic and honest solutions. Our team will cut through the jargon and speak with you in plain English, allowing you to understand your alternatives better and make the best financial decision possible. Regardless of your situation, we will guide you through a stress-free and seamless process. Furthermore, we will keep you updated on every stage of your purchasing process.

Our Services

We do more than get you a great interest rate when applying for a home loan. For you, we find the greatest overall deal. Here are five ways that we may help you:

- We work closely with you to determine your needs.

- We negotiate with lenders on your behalf.

- We get the best interest rates and lending terms possible.

- We take care of everything and keep you informed at all times.

- We meet your deadlines and take care of valuations and settlements.

- Did we mention it's all completely free? True, we can offer our services for free since lenders give us a commission.

When it comes to dealing with banks, you are not alone. So let us deal with the research. Whether it's your first Home, second Home, refinancing your current home, or buying an investment property, we'll care for you.

Melba Mortgage Broker Melbourne

431720615

About Melba Mortgage Broker

Our Director, Gary Lamba, has multiple Commbank honours and 13 years in the mortgage industry. As a Melba mortgage broker, his objective is to develop long-term relationships with clients based on trust and respect. We are a Melbourne-based boutique finance broking firm that takes a holistic approach to numerous financing solutions. We recognise that everyone's financial situation is unique, so we devote our efforts to achieving the best possible result, depending on your financial circumstances.

Since founding Melba Mortgage Broker, Gary's mission has been to help his clients reach their financial goals through due diligence, proper education, and the best finance options available through our network of top lenders. As a leading Melbourne broker, it is our responsibility to shop around and agitate the banks on your behalf because we feel it is your right to obtain the greatest finance deal the lending market offers.

Our Service

Melba Mortgage Broker strives to provide affordable home loan rates, rapid turnaround times, exclusive offers, and excellent customer service. That is why Melba Broker is becoming more and more popular among Australians. We want you to be able to pay off your mortgage faster. Combine your home loan with offset accounts to minimise the interest you pay on your mortgage if you look for a reputable and best home loan broker in Melbourne.

Finding a home loan these days can be extremely tough; therefore, one of the greatest things you can do is seek the assistance of the top home loan brokers in Melbourne. These Melbourne home loan brokers will not only assist you in locating the ideal loans for you from Melbourne's ideal home loan lenders, but they will also assist you in obtaining your ideal loan and so purchasing your ideal property.

There are several crucial variables to consider while discovering the ideal house loan for you. You must, for example, be aware of any special lending criteria. In addition, depending on the amount you need to spend to purchase the Home, you need also know how long it will take you to return the loan altogether. These considerations can be difficult and intimidating for potential house buyers, so working with a home loan broker in Melbourne is a good idea. They will guide you through the entire process and take the worry out of your decision.

Empower Wealth - Mortgage Brokers Melbourne

1300 123 842

About Empower Wealth - Mortgage Brokers Melbourne

To assist you in making money and wealth-creation decisions that will allow you to live a more satisfying life. But, of course, we are not implying that simply because we can assist you in increasing your riches, your life would be instantly satisfied; that would be too presumptuous of us. Instead, we welcome anyone who wishes to make a big difference in their financial situation and want to develop financial security in retirement to contact us.

- Clients

- Team

- Innovation

- People

- Guidance

- Growth

- Specialist

- Passionate

- Determined

- Committed

Our people are another one of Empower Wealth's key values. We believe in fostering an environment that allows our employees to grow into the top specialists in their fields. Therefore, we put all of our team members through a rigorous hiring process to ensure that we hire people passionate about wealth-building education, driven to deliver sound advice, and dedicated to our clients.

Our Services

Investors' Mortgage Broking

Your investment property portfolio's success depends on loan strategy and structure. To make sure you're on the right track, talk to one of our brokers. When it comes to property investing, statistics matter, and if you want to establish a property portfolio, be sure your finances are to support your goals. You'll need to think ahead of two or three homes to plan your financing properly. The financing procedure and dealing with banks may be stressful and difficult, whether you purchase your first investment property or have a few under your belt. Our brokers are here to make this procedure as straightforward as possible so that you can concentrate on more important matters.

Our brokers have years of experience in the field, and Empower Wealth is linked with all major banks and lending institutions, ensuring that you obtain the best loan rate and structure for your needs and goals. For example, suppose you're only looking for a restructure. In that case, our brokers will assess your existing loans as part of your broader financial picture and recommend methods and solutions to guarantee you have the greatest loan options and structures for your needs.

MoneyQuest Mortgage Brokers Melbourne

1300 886 100

About MoneyQuest Mortgage Brokers

Why should you go with MoneyQuest?

- Team carefully selected

- Local expertise

- A long-term strategy

- Additional loan possibilities

- Free of charge

- Various specialities

It All Began Here, MoneyQuest was created in 2007 with a clear mission: to make property ownership simple and profitable for everyday Australians. Since then, our nationwide network of mortgage brokers has assisted thousands of families and investors in securing their financial futures, from first-time homebuyers to retirees.

MoneyQuest expands into franchising. MoneyQuest announced the opening of its new franchise operation in May 2016. Our new franchise system provides a smarter distribution platform for franchise owners and a superior service proposition to our clients, designed for today's marketplace and tomorrow's savvy consumers. MoneyQuest has swiftly become the brand of choice for Australia's top mortgage brokers, thanks to a best-in-class proprietary dashboard, a multisource lead flow, an onsite film studio, and an online training academy.

Our Services

We could help you save money. Choosing a bank is a significant decision, but it does not have to last a lifetime. MoneyQuest can assist you in unlocking the equity in your property or determining whether you could be getting a better deal. Simply put, refinancing is paying off your present debt and replacing it with a more favourable one. Every day at MoneyQuest, we help clients better their financial situations by refinancing their debts. We negotiate on your behalf and assist you in answering the following critical questions:

- Is refinancing right now the best option for you?

- How easy will it be to get a new loan approved?

- What kind of home loan is best for your new requirements?

- How much does refinancing cost?

Own Home Loans - Mortgage Broker Melbourne

1300 721 631

About Own Home Loans - Melbourne

Own Home Loans takes the guesswork out of selecting the right loan and combines it with an experienced understanding of mortgage financing to provide you with a customised strategy to help you achieve your objectives.

Rory began his career in commercial finance over 15 years ago, where he developed his affinity for custom mortgage solutions, specialising in early repayment techniques. Rory established and maintained an award-winning Wizard Home Loans franchise after excelling in several positions across national financial institutions. The branch in the inner northern suburbs has continuously been recognised as one of Australia's best-performing branches. Rory swiftly established and maintained a reputation for going above and beyond for his clients by focusing on exceeding expectations. Not only settling home loans but also customer service and creating relationships with credit teams, allowing his clients to benefit from much more than just a suitable home loan. Rory continued to run his firm for another two years after Aussie Home Loans took over Wizard before moving into the fitness industry. He owned and operated his gym and franchise fitness business. Rory's skillset for running small-medium businesses grew due to this change, as did his love for assisting others in achieving their goals. Rory returned to the financial services industry as a senior business development manager at NAB Business Bank and a mortgage broker at a financial planning organisation. Rory and his team are helping average Australians fulfil their housing aspirations at his own Melbourne mortgage company, Own Home Loans, by striving for excellence in customer service and personalised loan solutions.

Our Services

Own Your Property

We look for ways for you to pay off your loan far faster than the typical mortgage term. We set a target date and devise a strategy to help you pay off your loan quickly, keeping your lifestyle goals in mind. We conduct monthly reviews to ensure that you stay on track to achieve your objectives. Maria Jovanovic, Client Services Manager

Maria has over a decade of finance experience before joining Own Home Loans, working in financial planning and asset finance. As the Customer Service Manager at OHL, Maria enjoys alleviating stress and supporting clients through the home loan process.

Thanks to her upbeat demeanour and can-do attitude, Maria guarantees that OHL's clients have a great experience, no matter how challenging their financial obligations may appear.

Control Your Future

We work with you to guarantee you Own your Future when it comes to growing wealth beyond your family home. We give you the greatest guidance in cooperation with a good team of financial experts to get you on the right track to financial success.

Manage Your Life

Do not allow debt to rule your life! We can help you get back in charge of your finances. You may reclaim control of your life with our debt restructuring method. We help you set a realistic timescale to Own your Home after developing a strategy to Own your Life.

Mel Finance Mortgage Broker Services Melbourne

1800 941 947

About Mel Finance Mortgage Broker Services - Melbourne

Mel Finance provides you with a free property report created by a prominent Australian property data solution business. We now only provide this complimentary service to Melbourne clients. As a forward-thinking brokerage firm, we believe in upgrading technology to provide the best possible service to our clients, ensuring that you receive a seamless experience that meets your expectations. Our up-to-date and comprehensive software will allow us to compare your requirements to hundreds of offers from other lenders. Following the completion of the comparison process, we will present you with a list of comprehensive home loan options, which will include details such as rates, terms, fees, charges, and repayments, all of which will be explained in plain English with no technical jargon, ensuring that all parties understand all details. Working with a local company allows you to readily contact us if you have any questions about your application procedure. It's never been easier to get in touch with us!

Our Services

Our specialised mortgage brokers can assist you in obtaining the finest home loan possible. Contact the Mel Finance team for individualised services for Home, business, and investor loans. We are situated in Melbourne and proudly serve clients from all across the city.

Independent Mortgage Broker Specialized Loan Services

We are a group of professional mortgage brokers committed to assisting our Melbourne-based clients in obtaining a loan that meets their specific requirements. We are trusted by personal, corporate, and investment clients to acquire low rates from our broad panel of lenders because we are industry professionals with expertise and insight. Mel Finance is your best bet if you're looking for a mortgage broker in Melbourne.

The Financial Approach Of Mel

We deal with homebuyers in Melbourne and provide a high level of service and support. We'll treat you like a person, not a transaction, like a bank may. When some providers put their needs first, we put yours first. Mel Finance can help you avoid long wait periods, indifferent service, perplexing policies, and a rotating workforce. Our knowledgeable staff works with a panel of lenders to locate the best possible offer for you. Use our straightforward mortgage repayment calculator.

Mortgage Finesse - Melbourne Broker

9020 1420

About Mortgage Finesse - Melbourne Broker

We understand how difficult obtaining a loan may be. That's why we're with you every step, keeping you informed and ensuring a smooth experience. Everything began in late 2002. I worked for a real estate investment firm that also made finance and property sales. I was attempting to balance both but failing miserably. So I decided to concentrate on finance and joined a firm where I worked with some high achievers and seasoned experts who taught me everything they knew.

I married the man of my dreams in 2004. Our first beautiful boy arrived in 2007, followed by two more (yep, we got twins!). Our family had expanded almost overnight! However, work had altered drastically during this time as well. My company had been sold to a major corporation, and the culture had shifted. Because my supervisors were departing, I decided to start my own finance company, Mortgage Finesse, in 2009. This allowed me the freedom I needed for our three young boys while also realising a long-held dream of owning a business. Since then, a lot has transpired. We started with a workstation in the front entry of my house and have now settled beachside in Edithvale after three other workplace migrations. Here, we can strike a work-life balance (as best we can) while remaining essential to many of our clients.

I've built up a huge clientele over the years, and many of them are still with me. They have witnessed my marriage, birth of my children, the establishment of my own business, and greying my hair! But, on the other hand, I've seen them do the same thing. Many of their children have grown up, and I've assisted them in obtaining mortgages for their own homes (some of whom I met as young as five years old!). I am incredibly proud of my background and the path my clients, and I have travelled together. I enjoy watching my clients develop and construct their lives over time, and I enjoy sharing the process with them.

Our Services

It's our job as your Broker to discover the right loan for you and make sure you can afford to pay it back. This is because ordinary life events can affect people's ability to repay their debts. Do you have a plan in place for how you – or your family – would pay off your debts in a major injury, illness, or even death? What if you were laid off?

A Simple Solution: A Loan Protection Plan.

A Loan Protection Plan is a type of insurance that can cover you and your family at a reasonable cost. It is available through our partner, ALI Group, and is tailored to home and property buyers.

It Is Something That No One Wants To Consider.

Unfortunately, 60% of Australians believe they would have to sell an asset within three months of losing their job1. As a result, it is unavoidable. However, we may be able to assist, which is wonderful news.

More Extensive coverage.

The ALI Loan Protection Plan is appealing because it covers you for 11 serious illnesses (which most super insurance policies do not), forced unemployment for the first five years, death, and terminal sickness. In addition, a medical exam is not required to obtain coverage. One final point to consider. The money is paid to you, not your lender, in the event of a payment.

You Get All Of The Benefits.

Unlike most other insurance policies, you get to decide how the money is spent. If you think you'd rather spend money elsewhere, such as on urgent medical expenditures, it doesn't have to go towards the mortgage. A holiday, too. You make the decision. Mortgage protection is simple and quick to set up for yourself and your family. When discussing your financing needs, be sure to ask about mortgage protection.

VDA Finance and Capital Mortgage Broker

1300 832 346

About VDA Finance and Capital Mortgage Broker

Fifteen years of experience assisting community members in achieving their financial objectives. With a combined 15 years of experience, you can rest assured that you are dealing with mortgage industry specialists when you interact with us. Each team member has experience in the residential and commercial mortgage industries, allowing us to give the best possible service to our clients during the home buying process. Our mortgage experts are not only experts in their business, but they are also passionate about helping our clients achieve their goals. Our top concern is your success, which we pledge to achieve through a simple, quick financing process.

Free And Without Obligation Consultations

Did you know that at VDA finance and capital, consultation regarding your specific financial situation is typically free? Instead, we get reimbursed by the bank or lender when we introduce you to them. If you're searching for a commercial loan, we charge a consultation fee. Because commercial or company loans are typically sophisticated, it takes a little longer for us to locate the best lending solution for you.

Rates That Benefit You.

Because of our unique high-volume relationships with our lenders, our team may be able to offer you the greatest interest rates. In addition, we are in the best position to find a loan package that fits your payback schedule and your financial circumstances. We go above and above to get you the greatest deal possible by requesting additional discounts. VDA specialises in locating interest rates that are beneficial to you.

Processes For Achieving Your Financial Objectives.

Our mortgage brokers and business loan professionals examine your position and recommend the financing solution that best meets your needs. We take the same customer-first approach when it comes to commercial loan applications and asset financing services. We understand that you need an expert to help you navigate a complicated mortgage and finance process, and we will do everything we can to help you make the best selections possible.

More Lenders Means More Options For Making Sound Financial Decisions.

Each customer and their scenario are unique to VDA Finance and Capital. As a result, we've mastered the art and science of providing customised loan comparisons and bespoke lending options across our diverse panel of lenders.

Our Services

Mortgages

We've got you covered whether you're purchasing your first home, a rental property, or seeking to refinance your mortgage. Our mortgage brokers are experts in all types of home loans and can assist you in obtaining the best rates from our network of over 40 lenders.

Loans To Businesses

We specialise in commercial loans, such as business loans to buy or refinance commercial real estate, residential or commercial property projects, land subdivisions, and land banking. For low doc, completely asset-based, land subdivision, and SMSF loans, we have access to all major banks and private funds.

Finance For Businesses And Equipment

Expand your business with the correct lender's financing for access to equipment, vehicles, and technology, depending on your company's position. Our in-house consultants will walk you through the process of Asset Financing, whether it's setting up a novated lease or a simple hire buy.

Aussie Melbourne Mortgage Broker

13 13 33

About Aussie Melbourne Mortgage Broker

With his young nephew James Symond by his side, John Symond founded Aussie Home Loans in 1992. They went on to the big banks as a team and forever changed the Australian mortgage market. Aussie was founded on family values and continues to operate as a family-style business today as part of the Lendi Group. We've been helping Australians realise their homeownership goals for over 30 years. We've assisted over one million Australians with their home loan needs. We guarantee to save you from the mysterious world of property finance.

Prioritising Customers

Aussie collaborates closely with industry and government to create a robust customer-first industry. Our staff is dedicated to finding new methods to improve the home loan process. We'll offer you the assurance you need to take action.

Local Australian Broker

We have over 1000 brokers and over 220 locations across Australia, making us the largest retail network in the country. No one knows Australia better than Australians.

Our brokers are part of their communities, and they are your neighbours, friends, and local mortgage specialists. So we're on your side. Your Aussie Broker can give you clear options and mortgage counselling that suit your home loan needs, thanks to our panel of over 20 reputable lenders* and 3000 loans.

Industry Acknowledgement

Aussie has received industry recognition on a national level, and in 2021, it was named The Adviser's Top Brokerage for the 9th year in a running.

Our Services

Have you ever wondered how much it costs to own a home? Nobody ever tells you everything there is to know about property ownership. So let's get a couple of things straight.

Duty On Stamps

Stamp duty, often known as transfer duty, is a one-time, state-based fee that varies depending on where you purchase. Stamp duty is computed using the purchase price of your home. The good news is that, in addition to the First Home Owner Grant, you may be eligible for significant stamp duty savings in several states. To figure out how much stamp duty you'll have to pay on your first house, use Aussie's stamp duty calculator. In addition, some lenders may offer money to first-time house buyers to cover the expense of stamp duty. If this describes you, it's a good idea to discuss your alternatives with your local Australian Broker.

Fees For A Conveyancer Or Solicitor

The title must be officially transferred into your name when you purchase your first house. Conveyancing is the term for this procedure, which requires legal knowledge. You might want to consider hiring a conveyancer or a solicitor to do this for you, just like you might consider paying a conveyancer or a solicitor to review the contract of sale before you sign it - the peace of mind can be worth the cost. However, conveyancing fees might vary, so look around and enquire about the fee before committing to a particular conveyancing firm or solicitor.

Inspections For Pests And Buildings

You don't want to acquire a house with shoddy construction or a significant insect problem. You should hire a professional pre-purchase pest and building inspection in addition to completing your checks before purchasing a home. Search for "pest and building inspections" in your area, read reviews, and contact a few providers to compare pricing.

Insurance For Mortgage Protection

Because your first house is likely to be your most valuable financial asset, it's important to secure your capacity to make loan payments with mortgage protection insurance. This protects you from defaulting on your loan payments if you become ill or lose your employment.

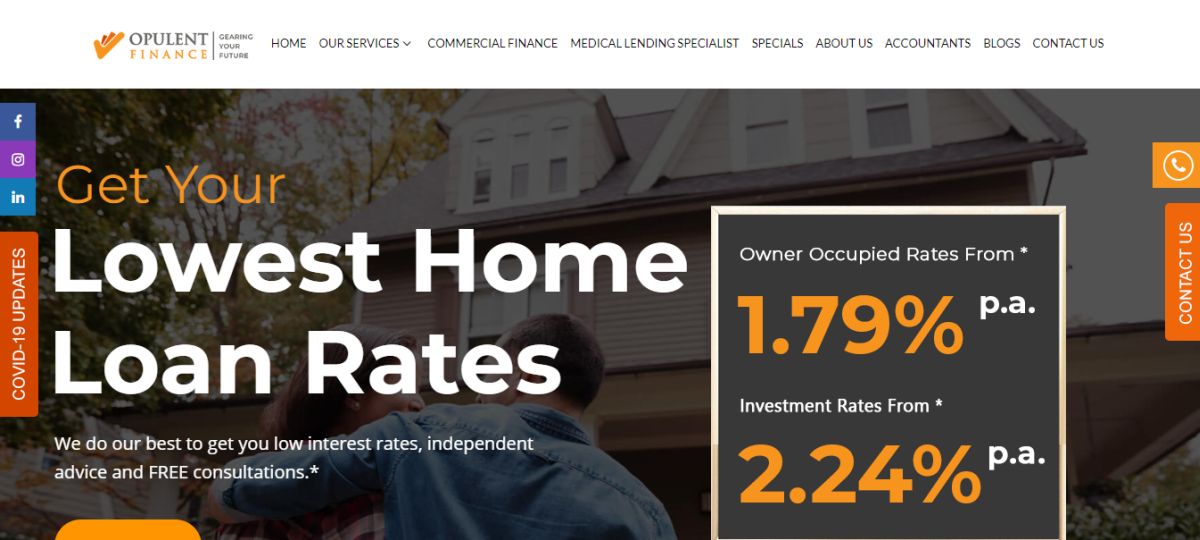

Opulent Finance- Mortgage Broker Melbourne

1300 001 551

About Opulent Finance Melbourne

We are a welcoming group that prioritises our customers' requirements. We will make great efforts to provide our customers with the best possible solution. That is why all of our clients refer us to their family, friends, and coworkers, and it is because of this, that we have expanded over time. The customer retention percentage at Opulent is over 98 per cent, which our seasoned team is quite pleased with. We are quite proud of our industry honours, but what we appreciate the most is that when we work with customers, we usually form a long-term relationship with them, aiding them with all of their and their family's financial needs for many years. Our consultations are completely free of charge, and we are not affiliated with any of the financial institutions on our panel. Our major goal is to find the best solutions for you. In addition, all of our customers benefit from our accounting and tax experience and expertise through Opulent accountants. We truly do provide you with the complete package.

Our Services

Loans For Investment Properties

Clients seeking assistance with obtaining an investment loan are beginning on unusual and interesting financial endeavours such as purchasing an investment property, building in your backyard, and off-the-plan investments. Investment property loans can be found readily through online mortgage providers, localised banks, or dealing with an investor-only lender. Rates and terms change depending on the borrower's condition, the property, and the type of loan, but mortgage rates are normally set on loan rate, and periods are usually based on three to thirty years.

- If you're considering investing in real estate, the first option is residential properties, with conforming mortgages being the greatest alternative for property loans. When you choose these loans, you will have the option of a fixed rate and the longest durations. However, these types of investment property loans come with significant drawbacks. If you're considering getting an investment property loan from an online mortgage buyer, it may be more convenient than getting one from a traditional lender.

- The entire process will be performed online, and no actual visits to the bank will be required to acquire a loan.

- The next accessible alternative is an investor-only lender, which makes financing to businesses and investors interested in investing in residential properties possible.

- This option is only available to enterprises, not people, and they are limited to four loans.

- The traditional mortgage system, which may be obtained from both national and regional banks and credit unions, is the third category of investment property loans. On the other hand, this alternative is perfect for those looking for price and convenience.

We consider each customer's demands individually and do not use a one-size-fits-all approach to property financing. The application process for obtaining a property loan is comparable to the lender's application process. You can easily work with the loan officer, who will set aside certain days for you to use this service. Following are the three stages you must take during the loan application process:

- Pre-Approval: You can assemble your financial criteria and submit them to the lender at the pre-approval stage of a property loan.

- Approval: Once your property loan has been approved, you can begin looking for and selecting the property you want to invest in.

- Closing: Once you've decided on a property, you'll need to wait for an appraisal and submit all supporting documentation that your loan provider has provided you with.

You can now choose conforming mortgage loan alternatives if you plan to invest in multiple places or if you want the freedom of opting through the internet option. First, we will listen to your goals and examine your existing condition to see whether they are realistic, and then we will discover the best investment loan package for you to attain your objectives.

Automobile Financing

We provide car financing for both individuals and businesses. Our skilled team is familiar with all of the choices and will give you the best option for getting your keys faster. We can assist you in the following areas:

- Mortgage on chattel

- Purchase of commercial rental

- Car loan

- Leasing

Mortgages

Melbourne's Market for house loan brokers is competitive and complex, especially for first-time buyers. The Opulent staff understands that every buyer has a unique position and goal; for example, some clients are pleased to be purchasing their first house, whilst more experienced home purchasers may be refinancing for home renovations or purchasing property for investment. We provide clients free consultations before scouring the Market for the best custom-built solution. As a result, we will remove all of the tension from the process and always get the greatest offer for our clients.

Burwood And Melbourne-based Bespoke Home Loan Brokers

If you are a first-time home buyer, we will process your application for a first-time homebuyer grant and make money available at settlement. Regardless of the type of house loan buyer you are, we are here to assist you:

- Buying an existing residence

- House and land packages are available.

- Packages not included in the plan (townhouse, unit or an apartment)

- Upgrading your primary residence or refinancing

- Home equity loan (if you are in between changing houses)

- A home loan with a family guarantee (help your children buy their first property with your home equity)

When applying for a house loan, it can be difficult to know where to start. Because there are so many options available, finding the correct category of first home buyer loans can be difficult. You can begin by calling local Burwood Home Loan Brokers for an assessment of your plans and a comparison to determine whether you are prequalified for a suitable home loan.

Mt Waverley House Loan With Low Rates For First-Time Buyers

It is critical to recognise that the various types of loans accessible from refinancing house loan firms range significantly. The financing for first-time house buyers is divided into three categories:

- A mortgage with Fixed Rates

- A mortgage with Variable Rates

- Mortgage hybrid (which is a blend of fixed & adjustable rates)

Apart from that, loans are classified as either governmental or conventional. The terms of such Home Loan Brokers Mt Waverley loans are determined by rules and policies established at the national level inside the country. Conforming and non-conforming loans are the two types of conventional loans available. It can also be considered an A-paper loan to enable and qualify for the position of conforming Home Loan Broker Glen Waverley. While there are many different mortgage brokers available for house buyers, it's important to talk to your mortgage company about the specific loans you might be eligible for, such as refinancing or buying your First Home.

You may easily unlock the door to a new beginning if you are thinking of making your dream house a reality and are looking for financial aid. Purchasing and owning a home in Burwood, Mt. Waverley, Glen Waverley, Melbourne, Australia, has become simple. The reason why people are looking into refinancing or loan choices is that they suit everyone's lifestyle. It is a simple choice for folks with low-income resources and unequal income distribution. Because not everyone can afford their own home, it is necessary to have something that allows for easy instalments and down payments.

Investors Mortgage Broker Melbourne

1300-468-733

About Investors Mortgage Broker Melbourne

Since 2007, Investors Mortgage has been assisting first-time buyers and investors with the goal of providing exceptional mortgage options to Australians. That aim has remained a driving force to this day. Investors Mortgage has always looked for the most innovative and responsible lenders in the country. As a result, we are one of the most well-known mortgage brokers in the country. To our clientele, we propose:

Our clients are not charged any fees for our services. The Bank or the Lender is the one who pays us.

- We don't add any margins to any of our loan offerings.

- We do not promote any one lender or product over another.

Why are we one of Australia's best:

- To bring you the most up-to-date information, we use the most cutting-edge mortgage processing technology.

- Our financial products range from basic to extraordinary. Both residential and commercial real estate transactions are something we've done before. We understand the needs of today's investor, and if you're seeking to buy your first house, we can help you finance it.

- We offer the lowest interest rates to ensure that your mortgage payments are as low as possible.

- We give you the resources you need to compare house loan interest rates in Australia, such as the Home loan repayment calculator.

- We provide our clients a first-time home buying guide and an investment property purchasing guide, as well as tools to determine your borrowing capacity and answer simple queries like 'How Much Can I Borrow?'

We operate with integrity, honesty, and a strong commitment to excellence. We never put profit before of quality. In reality, because of our established reputation, we have a lot of clout with our lenders. We design financial solutions with the end user in mind, so you can be confident you're getting the best loan available. Our goal is to educate clients about the advantages of property house loans and to build loans to maximise the borrower's financial leverage for portfolio growth.

Our Services

Mortgages

Let us do the legwork for you and locate the best home loan for you. Over 500 loan packages from over 40 lenders, including major banks, are compared. Since 2007, Investors Mortgage has been assisting first-time buyers and investors with the goal of providing exceptional mortgage options to Australians. Investors Mortgage has always looked for the most innovative and responsible lenders in the country. As a result, we are one of the most well-known mortgage brokers in the country.

- No margins on any loans – Fair We don't add any margins to any of our loan offerings. You get the same, if not a better, interest rate than you would if you went to a bank. Our e-Update system keeps clients informed about the status of their loan application every three days by email and phone.

- Clients do not pay a fee – clients do not pay a fee – Our clients are not charged any fees for our services. Because you are not using their space or staff, we are compensated by the banks or lenders.

- Long-term perspective — We structure loans for our clients' long-term advantage.

- Honesty - We don't favour one lender over another or one product over another. Lenders and products are chosen solely on the basis of their qualities and suitability for the client. It is our responsibility to serve your best interests.

- Market study - To assist clients in selecting and finalising a property, we provide a Comparative Market Analysis for their chosen property and suburb.

Inovayt Mortgage Broker Melbourne

1300 354 355

About Inovayt Mortgage Broker Melbourne

Inovayt was founded in 2007 by Nick Reilly and Renee Kiley as a mortgage broking company and has since evolved to become one of Australia's most recognised independently owned financial services companies. To better serve our clients, Inovayt currently has over 40 employees, four offices across the country, and a commercial section. Inovayt makes an effort to truly comprehend their clients' requirements. They carefully examine what you need today as well as what you might need tomorrow as part of their commitment to providing great customer service.

Why Should You Pick Inovayt?

- Quality guidance and support from seasoned experts will be provided at every level of your financial journey.

- We keep things simple by communicating by email, phone, or in person.

- You have a devoted team of pros on your side that know how to get the job done.

- Our end-to-end solutions will make your life easier.

Our Services

Your First Residence

Purchasing your first house will be one of your most significant financial achievements, and there are numerous options available. We keep you updated at every step of your trip.

Your Next Residence

We want to help you identify the greatest possibilities for buying your next home at Inovayt.

New To Investing?

Inovayt is here to assist you in every step of your home investment journey.

Property Investing Expert

There are certain crucial aspects to consider if you're a property investor trying to expand your portfolio and boost your wealth.

Refinancing

We can assist you at every stage of the refinancing process, from debt consolidation to achieving a better interest rate. If you answered more than two years ago, you might be overpaying. Your financial situation should not be left to chance. When the timing is appropriate, we advise our clients to refinance or consolidate their debt if their circumstances allow it. You should examine your house loan every two years, or sooner if one of the following situations occurs:

- You've been offered a raise in pay and/or a new position.

- You've been laid off.

- You start planning your family.

- Your kids start supporting themselves financially.

- Property values increasing or declining

- Interest rates change after the end of a Fixed Rate Period.

Reviewing your mortgage is sometimes overlooked as "too difficult," but with our help, it's not so difficult. If you don't review it, you could be losing out on some significant savings. We wish to assist you in locating the finest mortgage for your specific circumstances.

Consolidation Of Debts

Consolidating your personal debt can be a good way to free up cash flow each month so you can pay off the debt in a neatly bundled recurring payment. Second, consolidating your high-interest personal debt into a low-interest home loan will help you pay off your debt faster because less of your monthly payment goes to interest.

An Improved Interest Rate

As an owner-occupier, saving money on monthly interest is the surest method to pay off your mortgage faster. Maintaining your monthly P&I repayment while lowering your monthly interest charge is a tried and true approach for getting out of debt faster. By lowering your interest rate, you can boost cashflow on your investment property with Interest Only repayments.

Features

With loan features like an offset account, redraw capability, and extra repayments, you can make your money work harder for you. These features, combined with some different money management practises, can help you pay off your loan faster.

Debt Restructuring

Refinancing is an excellent way to restructure existing debt due to events such title ownership changes, divorce, property transfers, and tax advice.

Refinancing Your Mortgage

Home loans should not be taken lightly! There are numerous reasons why refinancing should be your top priority, including the chance to save thousands of dollars by switching to a lower interest rate.

MortgageCorp - Mortgage Broker Melbourne

1300 138 943

About MortgageCorp Melbourne

We specialise in assisting full-time successful professionals in purchasing 1 to 5 investment properties in 5 years [through smart financing] so that they can have consistent passive income coming in before retiring and continue to live the life of their dreams even after retirement when others are downsizing, reducing expenses, and living on a budget. Without our assistance, successful professionals will lack a clear roadmap for starting and growing a profitable property portfolio, will waste valuable time (up to ten years) not getting on the right track to financial freedom, or, even worse, will receive incorrect advice that will lead to an endless cycle of stress, wasted time, money, and opportunities. This makes their lives a living hell because they'll be constantly worried about money, wondering what life will be like when they retire, and looking back in 5, 10 years living the same lifestyle they did without a plan for the future while enviously watching their friends reap the benefits of passive income.

However, with our assistance, these professionals will be confident in their future for themselves and their families because they will know what to do and how to prepare themselves to attain their objectives and financial independence. Instead of being controlled by their job or the government, people will be able to break away from the rat race, work on their own terms, and accomplish what they want. They'll be able to take charge of their finances and devote more time to the things that matter most to them, such as their passion, health, and family. And they'll be able to provide their family, their children, and their children's children a better life. We only work with a few clients at a time, which allows us to concentrate on getting them the results they require.

Our Services

A first-time home buyer seeking affordable rates and a rapid loan approval with minimal hassle. Purchasing a home may be a stressful process. You must not only discover a home that suits your needs and budget, but you must also obtain a home loan that is appropriate for your situation. The following are the (very) basic steps in this procedure:

- To avoid disappointment, apply to check whether you qualify for pre-approval financing before looking for property.

- Performing research and locating the ideal property

- Obtaining the services of a solicitor or conveyancer to review the documents

- completing your purchase, requesting a settlement date, and deposit payment

- The settlement period is when the paperwork is completed and the house is inspected for the final time.

It's difficult enough when you have to handle everything alone without the help of an industry insider. However, as any seasoned property owner will tell you, working with an inexperienced mortgage broker may be even more frustrating. You might find yourself with:

- squandered time on lengthy applications with banks that had no intention of ever lending you money squandered money on interest, fees, and taxes as a result of incomplete or inept advice received disappointing service that ends the moment you sign the dotted line (in the mortgage industry, this is known as 'catch and kill')

- It's made worse if you get the wrong house loan - one that has too high an interest rate, is structured incorrectly and costs too much in taxes, and has the wrong terms that force you to pay too much for too long.

What Makes Mortgage Corp Unique?

Our mortgage brokers have over ten years of experience in residential loans as well as more complex investment loans. We truly want to assist you in obtaining the best loan (and loan structure) for your needs. We provide home purchasers with the knowledge they need to feel confidence in their decision–after all, it's the largest purchase most people will ever make. More significantly, our strategic approach means we adopt a long-term perspective, aiming to maximise future investment choices so you may establish a profitable property portfolio faster and achieve your financial goals sooner. And, because we've earned the coveted 'Premium Broker' status with a number of lenders, we can provide you with:

- Premium pricing

- Flexible circumstances

- Loan applications processed quickly

- Low or no costs, as well as other insider benefits

It's also worth noting that our home buyer services are usually provided at no cost to you. For our services, banks or lenders pay us a completely transparent charge. This has no bearing on the loan or the interest rate. In fact, we can obtain you lower rates and more flexible terms that many other brokers can't because of our premium broker position with several institutions. So, if you want to:

- Without the stress and hassles of dealing with banks or inexperienced brokers, get the proper loan the first time.

- To maximise your long-term loan serviceability, tax savings, and asset development, use a deliberate, planned strategy.

- Get exclusive premium rates, terms, and concierge service on all of your loans.

- Then schedule your Free Finance Solution Session to find out exactly where you are in your quest for a new home now.

Make an appointment now for a FREE 30-minute Finance Solution Session over the phone with our company's founder and Chief Finance Expert Neil Carstairs to learn how we can assist you in obtaining a competitive home loan that will help you achieve long-term financial success!

Loanscope Mortgage Broker Melbourne

03 9988 1818

About Loanscope Mortgage Broker Melbourne

By delivering on our promises of quality service, experienced advice, and personalised loans at low, low rates, Loanscope has set the bar for financial broking in Melbourne. We:

- Loanscope provides customised and personalised services.

- We adopt a long-term perspective.

- Home loans from over 30 different lenders can be compared.

- We offer skilled guidance.

- Loanscope has a strong track record of approving house loans.

- We simplify the procedure.

- Our office is conveniently located in the St Kilda Road sector, just 5 minutes from the CBD, but we can come to you if necessary.

- As needed, we offer after-hours appointments.

- Loanscope is always looking out for your best interests.

- We are members of the Australian Finance Brokers Association.

Loanscope has established a great reputation and excellent ties with major banks, non-bank lenders, and non-conforming lenders as a rising finance brokerage. We have access to hundreds of home loan packages and the experience to identify one that meets your current and future financial goals. To complement our service, we may recommend qualified conveyancers, accountants, financial advisors, and other specialists.

Our Services

Loanscope: Increasing the profitability of your real estate investment. Loanscope provides:

- Simple explanations to help you understand your property investment possibilities.

- Expert property investment advice based on your unique structures and objectives.

- Banks are unable to provide a wide selection of mortgage options (or match).

- Through complicated talks, you'll have an expert on your side, negotiating rates that will astound your bank.

- A solid investing plan to help your SMSF grow.

Our knowledgeable Melbourne mortgage brokers can come to you – and meet with you when and where it is most convenient for you in the Greater Melbourne area.

State Financial Services - Mortgage Broker Melbourne

1300 395 824

About State Financial Services - Melbourne

To be the industry's most trusted partner in helping our customers achieve their financial goals. To be the industry leader in offering socially responsible and morally sound financial services while maintaining the highest degree of customer service and agility.

Our Principles

- Gratitude.

- Integrity and trustworthiness.

- Socially and ethically conscious.

- Innovative and Agile Thinking

- Focused on Customers and Industry

Our Knowledge.

We have access to loans from a number of Australia's best lenders, one of which could be the right fit for you, whether it's for your first house, refinancing your present property, or investing. Finding one that meets your requirements and goals is difficult, but State Financial Services Brokers can assist you. We'll investigate a variety of ideas to help you find the right answer.

We are a mortgage brokerage firm.

It is our responsibility to find the best financing for you. We achieve this by assisting you in navigating the market's options and developments, as well as negotiating on your behalf. We commit to handle the entire process for you once we've located the best loan for you.

We'll be there from beginning to end.

We're not simply here to assist you locate the perfect loan for you. We're here to help you through the process. Once we've located a loan, we'll assist with the paperwork and oversee the application process until it's approved. You can contact us at any time during your financial journey by phone or email. You can book an obligation-free consultation with us at any time that suits you, whether you're about to buy, want to increase your investment portfolio, renovate, or simply review.

You have priority.

We'll ask about your financial situation and aspirations when we meet so we can figure out what's most essential to you in a house loan. You might need flexibility because you're preparing to start a family, or you might need quick equity access for a rental property or improvements. There are several options available, and we'll make a recommendation based on your requirements. You can trust State Financial Services because YOU, not the lender, are our top priority.

Our Services

One of the most important decisions you will make in your life is to purchase a home. We're here to assist you by ensuring you have all of the necessary information and options to discover the correct financing for the home you want to buy. There are a plethora of house loan options available, with new ones being introduced on a regular basis, not to mention special discounts and other 'deals.' A State Financial Services broker will not only assist you in finding the right loan for your circumstances, but will also help you fill out the paperwork and submit the application on your behalf. More than half of Australian borrowers now utilise a broker to acquire a home loan as a result of this. You might want to visit our Different Loan Types page before you utilise a broker to have a better idea of your alternatives. You might also use our online calculators to figure out how much you can borrow and how much you'll have to pay back.

Melbourne Auslend Financial Services

03 9111 5712

About Melbourne Auslend Financial Services

AusLend Mortgage Advisers are industry-qualified and accredited finance specialists who can offer you peace of mind, continuing support, and long-term solutions.

Our Vision And Mission

AusLend's objective is to provide Australians with the knowledge they need to get the most out of their largest financial investment by properly organising their finances to help people pay off their debts sooner rather than later and achieve their financial goals.

Why go with AusLend?

We know how to successfully guide you through the home loan process and prevent potential stumbling blocks that could cost you hundreds of dollars in bank fees and/or charges. After all, we don't work for the bank, but for you.

Experts With Qualifications

When it comes to making critical financial decisions, you need sound, up-to-date counsel you can trust. As a result, we only hire experienced mortgage counsellors who can provide you with that knowledge and peace of mind.

There Are No Surprises

One of the reasons our clients appreciate us is our transparency. Our brokers are always available to provide all information and answers to your questions, in addition to our online calculators.

Rating For Success Stories

Our competence and dedication are demonstrated by the large number of successful tales. That is why the majority of our satisfied customers rave about us and refer their family and friends.

What Do We Have?

We know how to successfully guide you through the home loan process and prevent potential stumbling blocks that could cost you hundreds of dollars in bank fees and/or charges. After all, we don't work for the bank, but for you.

Experts With Qualifications

When it comes to making critical financial decisions, you need sound, up-to-date counsel you can trust. As a result, we only hire experienced mortgage counsellors who can provide you with that knowledge and peace of mind.

There Are No Surprises!

One of the reasons our clients appreciate us is our transparency. Our brokers are always available to provide all information and answers to your questions, in addition to our online calculators.

Rating For Success Stories

Our competence and dedication are demonstrated by the large number of successful tales. That is why the majority of our satisfied customers rave about us and refer their family and friends.

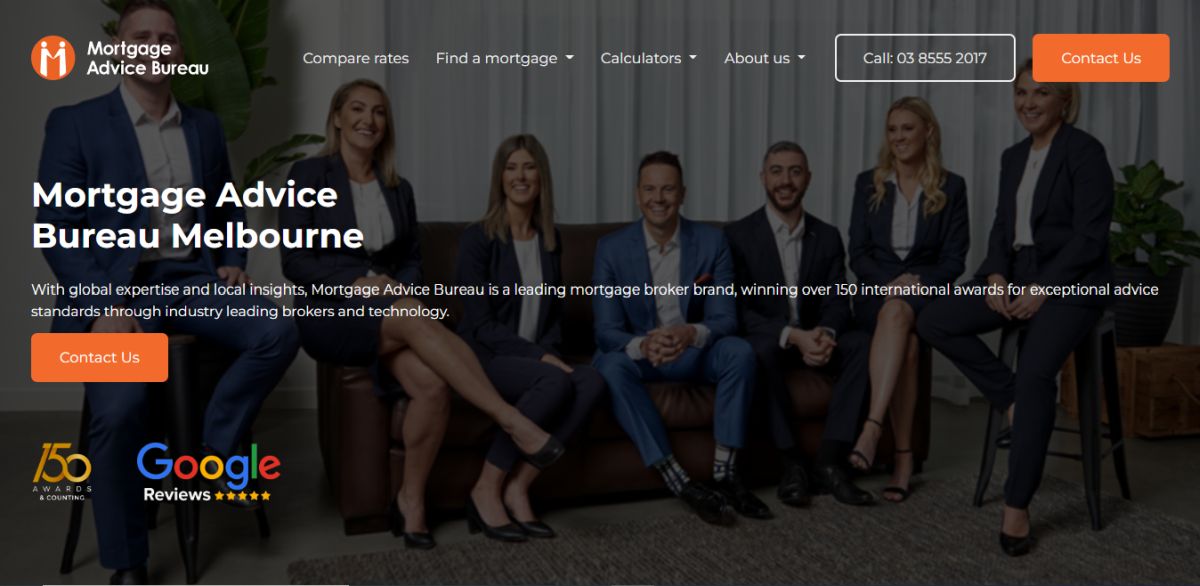

Mortgage Advice Bureau Melbourne

03 8555 2017

About Mortgage Advice Bureau Melbourne

Josh has increased his team to ten experienced members as a result of his successes. MAB Melbourne has professionals in all areas of financing, including construction, first home buyers, investment loans, re-finance specialist, debt consolidation, asset/car finance, and commercial loans. The crew is incredibly skilled and can give outstanding service no matter what the client is looking to do because they have lending specialists in each of these areas. You will feel confident in the team's ability to offer the best solution so you can fulfil your financial objectives from the first meeting. It's no surprise that they have so many adoring followers and glowing reviews. This award-winning mortgage brokerage team will help you cut through the jargon, comprehend the world of mortgages, and feel at ease every step of the way, no matter which path you choose.

Our Services

It is our responsibility to find the best financing for you. We achieve this by assisting you in navigating the market's options and developments. Then we go to bat for you, and we can even negotiate for you. We'll assist you with the entire process after we've discovered a loan that we like. We have access to loans from a number of Australia's best lenders, one of which could be the right fit for you, whether it's for your first house, refinancing your present property, or investing. Finding the right one for you is difficult, which is where we come in. We'll look at a variety of possibilities to help you find the right answer. We're not simply here to assist you locate the perfect loan for you. We're here to help you through the process. We'll assist with paperwork or manage the application process until it's approved once we've located a loan.

SCM Finance Solutions - Mortgage Broker

03 9002 0075

About SCM Finance Solutions - Mortgage Broker

Simply defined, a mortgage broker's responsibility is to locate you the best home loan for your needs and to ensure that you keep that loan if your goals and circumstances change.

Transparency

We go to great lengths to ensure that our consumers understand why and how we make loan recommendations.

Culture And Government

We shall always follow the law and work with any regulatory agencies. Our role is to adapt, lead, and shape industry best practise.

Conflicts Of Interest Should Be Managed.

From time to time, conflicts can arise. We shall disclose any conflicts of interest to our customers and always prioritise their demands.

Professionals Who Are Dedicated To Their Work

We invest in ourselves and our company to achieve exceptional results for you. You can trust us to keep, develop, and apply a high level of knowledge and abilities to fulfil all industry requirements and qualifications.

Quality

We shall do everything necessary to keep client records in a comprehensive, accurate, and secure format.

What are we going to do for you?

Here's how we'll work together, from establishing your goals to settlement and beyond.

Recognize Your Objectives.

We'll take the time to learn about your specific situation and objectives.

Give You Some Alternatives

We'll conduct extensive research, present you with a few loan possibilities, and assist you in making your decision.

Have It Taken Care Of For You.

Once you've decided on a loan, we'll take care of getting it deposited, approved, and settled.

Assist You In Saving

We'll keep in touch to make sure you're still on the right loan if your circumstances change (and to save you money!).

Mortgage Victory Financial Broker

0414 895 596

About Mortgage Victory Financial Broker

What exactly are our identities? Mortgage brokers are what we do. We'll help you locate the best loan for you by navigating the competitive and ever-changing mortgage landscape. We'll go to bat for you and negotiate on your behalf, making the process as simple as possible for you and focused on getting you results quickly. We'll guide you through the process and identify loan features that are right for you. When seeking for financing, why should you choose us as a mortgage broker?

A mortgage broker looks for the best house loan for you. We provide access to hundreds of loans from a variety of Australia's best lenders, whether you're buying your first home or creating a portfolio of investment properties. We take care of all the tedious tasks. We'll make sure you get the best house loan for your needs and oversee the entire process. What should you expect when you come to see us and when should you come to see us? You can come to us at any point along your financial path. You may be saving for your first house, wishing to utilise the equity in your present one, or wondering if your current lender is still offering you the best price. You may schedule an appointment with us at any time and location that is convenient for you.

To find out what's important to you in a house loan, we'll ask about your financial conditions and goals. For instance, you might need flexibility because you want to have a family or because you need quick access to equity for a rental property or improvements. Whatever your intentions are, we'll conduct market research and make a recommendation for the best house loan for you. Not the lender, but you.

Our Services

Purchasing Your First Home

Purchasing your first home is an exciting, but daunting, move that comes with numerous questions and decisions. The first important concern is how much money you can borrow and how much you'll have to pay back. That's where we come in; we'll take care of the research. We can compare home loans from Australia's top lending institutions across a range of options. You may also be eligible for a first-time home buyer award because you're a first-time buyer. This award may be given to Australian citizens or permanent residents who want to buy or build their first house within 12 months of settling in Australia. Because award conditions differ by state, contact us to learn more about your state's eligibility requirements and how much grant money you might be eligible for. We'll also communicate with the lender. It's our responsibility to do the legwork so you can concentrate on finding the perfect house. We'll be with you every step of the way, from application to approval, to help you understand the home loan process.

Home Loan Refinancing

Where do you begin, though? We can assist you in putting everything into perspective. Situations alter as time goes by. Maybe you've made a career change? Or perhaps the family has grown by one? Perhaps you simply want a lower price? Maybe it's because of the introduction of school fees, or maybe the kids have moved out? Or perhaps that dripping bathroom or worn-out kitchen has finally given up the ghost.

A change in circumstances may indicate that it's time to review your household finances. Refinancing a mortgage is a scary prospect for many people. Fees must be addressed, as well as fixed vs. variable interest rates. The appropriate refinanced loan could help you pay off your mortgage faster and for less money, eliminate unhealthy debt, or upgrade and increase the value of your home, all of which are positive moves.