This blog post will list some of Melbourne's best financial planners and advisors. We'll also provide some information about what to look for when choosing a financial planner or advisor. So if you're ready, let's get started!

Like most people, you understand the importance of having a financial planner, but you may not know how to find the right one for you.

This blog post will outline some tips on finding a financial planner that fits your needs. First, consider what your goals and needs are. For example, are you looking to save for retirement? Invest in property? Reduce your taxes? Then, do your research and ask around for recommendations. Next, narrow down your list to a few finalists and meet them for an initial consultation. Finally, make sure to review their fees and services before deciding.

With these tips in mind, you're sure to find the perfect financial planner for you!

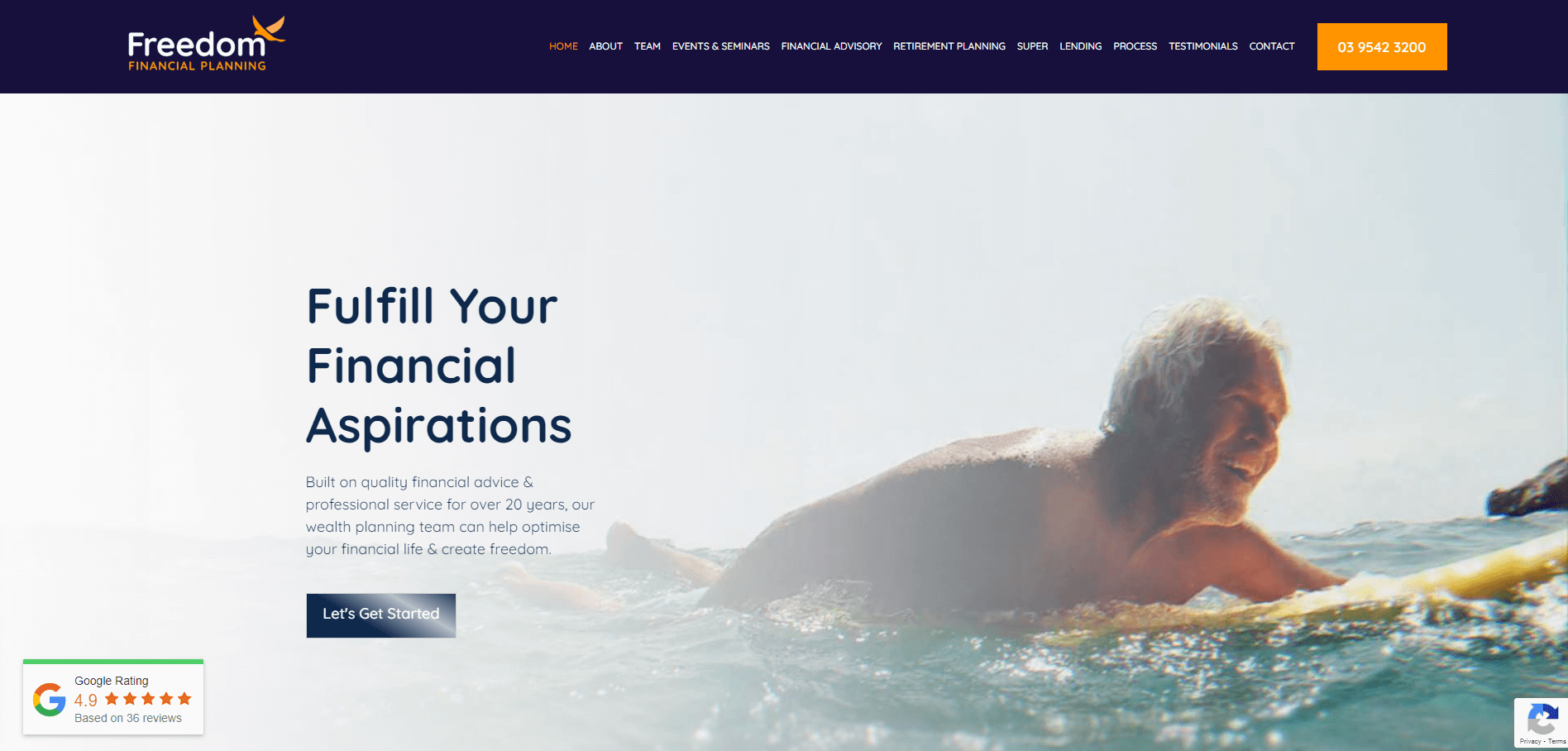

Freedom Financial Planning

Freedom Financial Planning is a distinguished financial advisory firm based in Notting Hill, Melbourne, renowned for its personalised service and expertise in financial planning. For over 20 years, the firm has been instrumental in helping clients craft tailored financial strategies that address their individual goals and circumstances.

From superannuation management to strategic tax planning and mortgage broking, Freedom Financial Planning offers a holistic approach to financial management, underpinned by a commitment to building lasting client relationships and ensuring financial well-being.

Services offered include:

- Superannuation Management

- Strategic Tax Planning

- Mortgage Broking

- Personal Risk Insurance Advice

- Cashflow & Budgeting Advice

Phone: 03 9542 3200

Email: askus@freedomfp.com.au

Address: Suite 29, 270 Ferntree Gully Road, Notting Hill VIC 3168

Website: https://freedomfinancialplanning.com.au/

Klear Picture

Klear Picture in Melbourne specialises in delivering expert financial and wealth management advice. They offer a comprehensive suite of services designed to empower clients in achieve their financial aspirations. The firm's commitment to personalised service ensures that each client's financial plan is meticulously tailored to their specific needs.

Services Offered:

- Accounting & Taxation: Customised solutions for individuals and businesses.

- Business Advisory: Strategic insights for effective financial management.

- Private Wealth Advisory: Comprehensive wealth creation and protection strategies.

- Lending & Capital Raising: Financing options for various real estate projects.

Address: 312/434 St. Kilda Road, VIC 3004

Phone: (03) 9998 1940

Email: team@klearpicture.com.au

Website: klearpicture.com.au

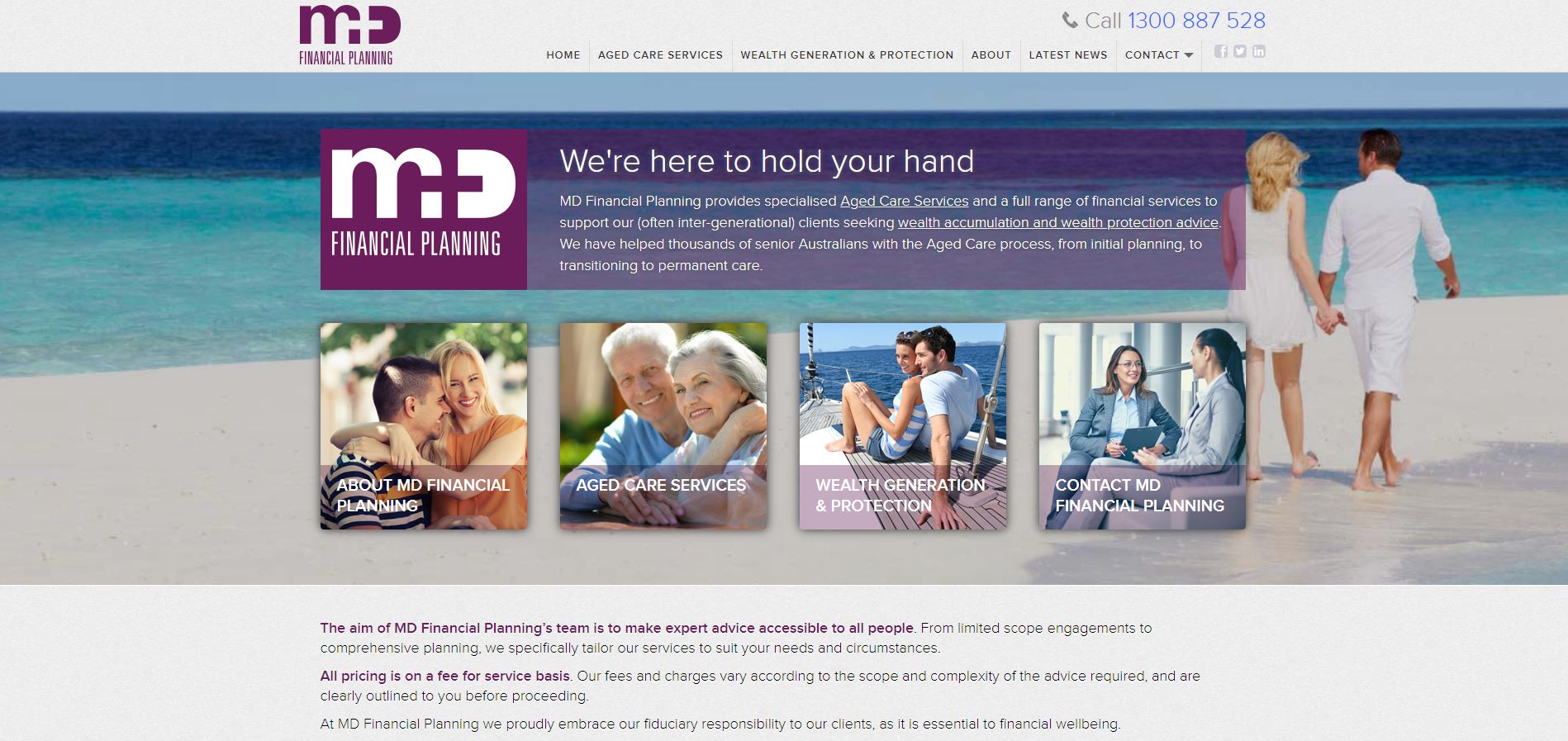

MD Financial Planning

MD Financial Planning specialises in providing a full range of financial services, with a particular focus on Aged Care services. They have a strong track record of assisting senior Australians with the Aged Care process, encompassing everything from initial planning to transitioning to permanent care. The team at MD Financial Planning is committed to making expert financial advice accessible to all, offering services that range from limited scope engagements to comprehensive planning. They tailor their services to suit the unique needs and circumstances of each client, ensuring that all advice is personalised and relevant.

Services offered by MD Financial Planning include:

- Aged Care Services: specialised support for senior Australians transitioning to aged care.

- Wealth Generation & Protection: Providing advice and strategies for wealth accumulation and protection.

Phone: 1300 887 528

Email: info@mdfinancial.com.au

Website: https://www.mdfinancial.com.au/

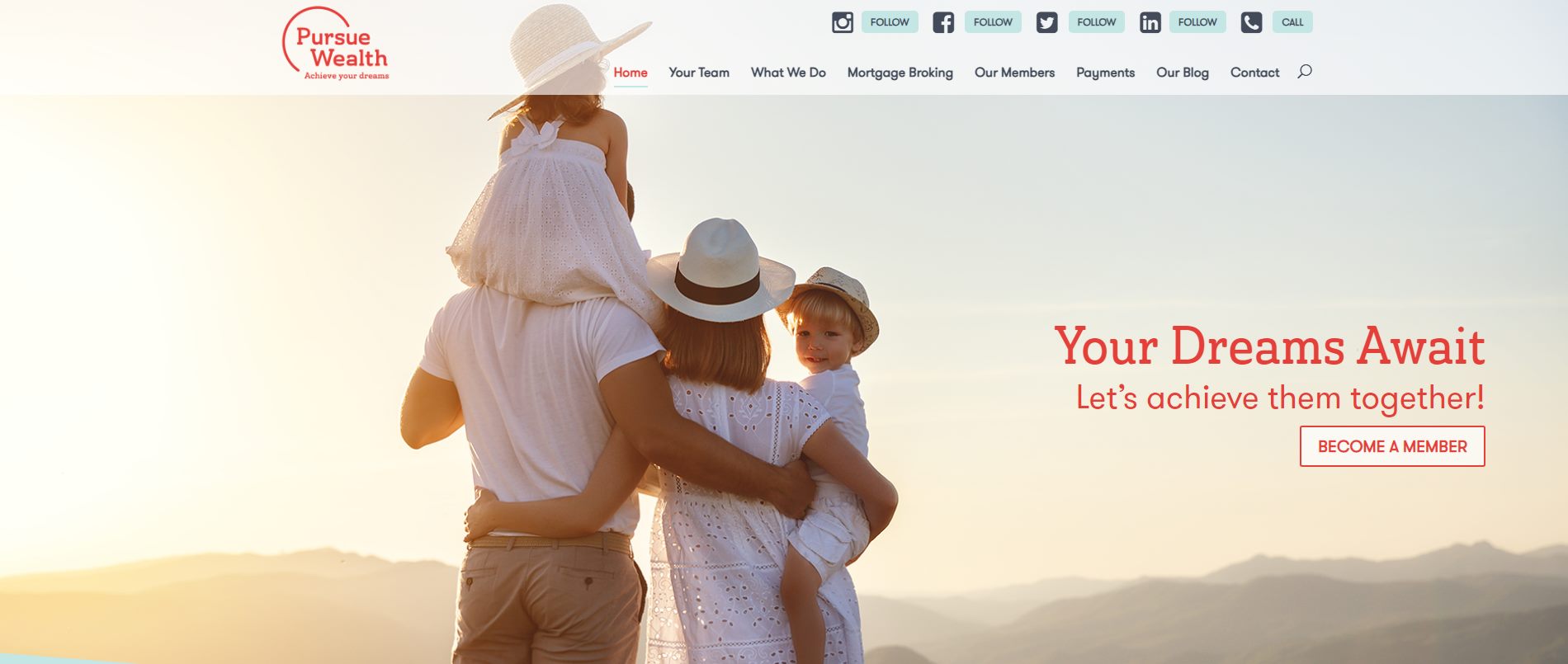

Pursue Wealth

Pursue Wealth specialises in creating financial plans that guide clients towards achieving their financial goals. They focus on setting short-term, mid-term, and long-term goals, helping clients feel accomplished and reminding them of the reasons behind their financial journey. Pursue Wealth works closely with clients to establish manageable targets and develop plans to achieve them. The duration of the planning process varies depending on the complexity of the client's financial situation and their urgency in getting a plan in place. Pursue Wealth emphasises the importance of understanding the client's vision for the future to create an effective financial plan.

Services offered by Pursue Wealth include:

- Financial Planning: Developing comprehensive financial plans tailored to individual goals.

- Superannuation Advice: Providing advice on superannuation options.

- Investment Advice: Assistance with investment decisions, including shares.

Phone: (03) 9686 1784

Email: advice@pursuewealth.com.au

Website: https://pursuewealth.com.au/

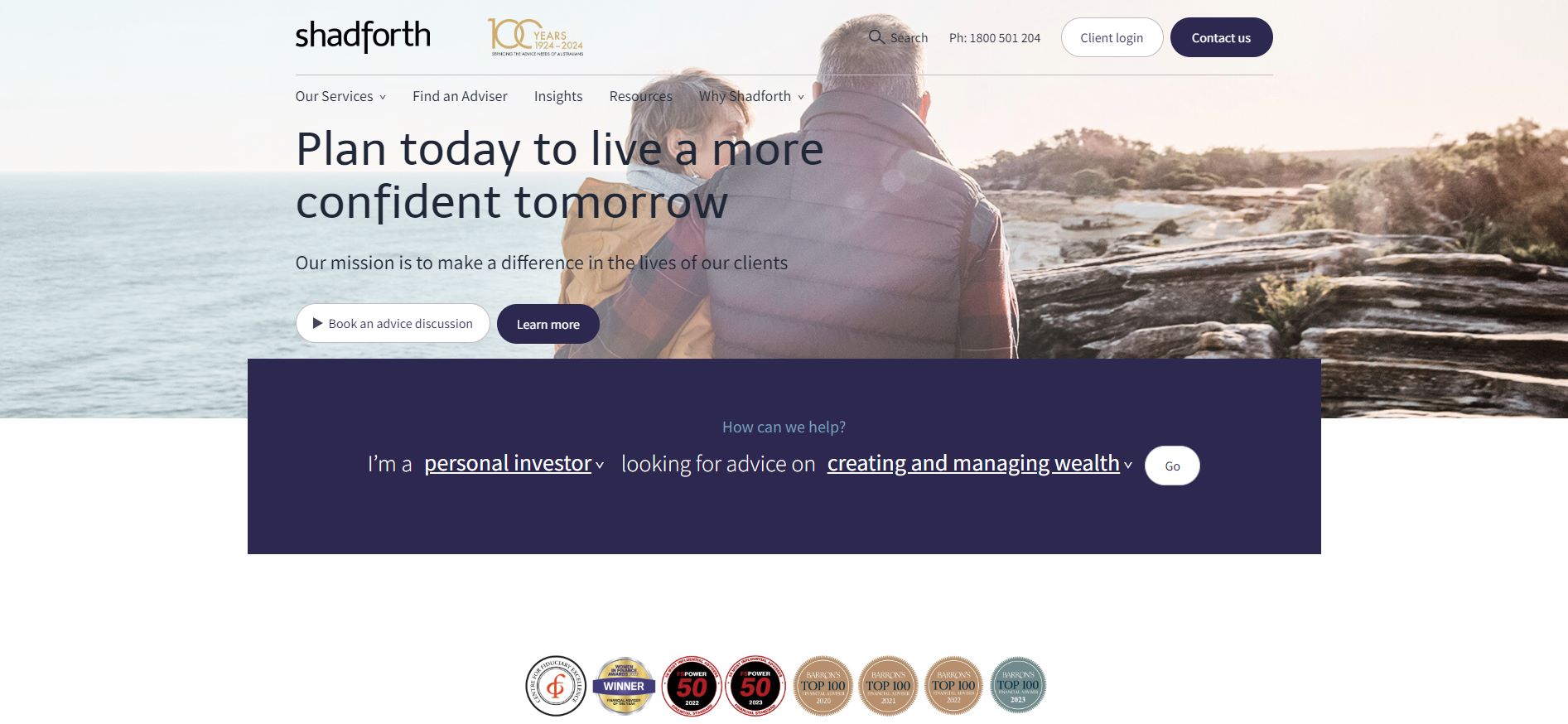

Shadforth

Shadforth Financial Group offers a comprehensive range of advice services designed to help clients create, manage, and protect their wealth, with the ultimate goal of achieving financial independence. They provide a complete wealth advice offering, catering to various life stages and circumstances, including saving for specific goals, navigating life transitions such as divorce, transitioning to retirement, or general financial decision-making. Shadforth's approach is centered around providing clear and relevant advice, underpinned by an investment philosophy that is evidence-based and focused on achieving clients' financial objectives.

Services offered by Shadforth Financial Group include:

- Private Wealth: Comprehensive solutions and strategies for both simple and complex financial needs, applying a total balance sheet approach.

- Investments: Evidence-based investment principles, tailored portfolios, and cutting-edge solutions.

- Retirement Planning: Strategic planning to facilitate a smooth transition from working life to retirement.

- Insurance: Personal and general insurance solutions to secure clients' future and provide peace of mind.

- Estate Planning: Strategies and structures to protect and preserve clients' legacy for future generations.

- Business Advice: Specialised wealth advice for business owners, including tax optimisation and employee protection.

Phone: 1800 501 204

Email: contactus@sfg.com.au

Website: https://www.sfg.com.au/

Financial Coaching

Financial Coaching Australia focuses on wealth creation, retirement planning, risk insurance, and self-managed super funds (SMSF), among other services. They aim to build financial security for clients, allowing them to enjoy their lifestyle in the future. The firm assists clients in making informed investment decisions based on various factors, including investment objectives, risk approach, and investment duration. They provide personalised financial solutions and strategies to help clients reach their financial goals, whether for business financing, lifestyle, private education, or retirement planning. Financial Coaching Australia also emphasises the importance of planning for retirement, offering advice on superannuation and strategies to maximise retirement savings.

Services offered by Financial Coaching Australia include:

- Wealth Creation: Building financial security and advising on investment decisions.

- Retirement Planning: Offering strategic plans for a smooth transition to retirement.

- Risk Insurance: Providing protection against financial implications of events like death, disablement, serious illness, or injury.

- Self-Managed Super Funds (SMSF): Assisting with the establishment and ongoing management of SMSFs.

- Business Succession Planning: Guidance on establishing business succession plans.

- Business Insurance Policy Ownership Structures: Advising on various policy ownership structures.

- Debt Reduction Strategies: Strategies for using assets to reduce debt and debt elimination.

- Taxation Structures: Developing tax-effective investment strategies and retirement tax management.

- Corporate Superannuation: Comprehensive services for company super fund requirements.

Phone: (03) 9821 4100

Email: pc@financialcoaching.net.au

Website: https://www.financialcoaching.net.au/

Mint Advisory

Mint Advisory, founded by David Dooley, is a boutique financial planning practice based in Melbourne, Australia. It has established a solid reputation over the past 20 years for providing strategic advice and clear direction to assist both individuals and organisations in navigating today's complex marketplace. The team at Mint Advisory is dedicated to solving clients' important problems and delivering practical, commercial financial planning services. They focus on building strong, productive relationships with a diverse range of clients, including wealth accumulators, retirees, business owners, companies seeking default super funds, and separated couples needing financial solutions.

Services offered by Mint Advisory include:

- Superior Client Service: Allocation of a Relationship Manager to each client to oversee all work and address concerns.

- Cost-effectiveness: Competitive rates for senior financial planning advice without large overheads.

- Wealth of Experience: Solutions-based financial advice from a team of experienced consultants.

- Independence: Recommendations based on independent research, not obligated to any investment or insurance provider.

- Access to Financial Adviser: Ensuring advisers are available and contactable to address client requirements.

- Solutions-based Approach: Providing practical, commercial solutions aligned with clients' strategic directions.

- Tailored Services for Healthcare Professionals: Specialised services including superannuation, personal protection cover, budgeting, cash flow management, estate planning, business succession planning, and retirement planning.

Phone: 03 9525 2879

Website: https://www.mintadvisory.com.au/

National Financial Planners

National Financial Planners (NFP), based in Melbourne, Australia, is dedicated to building successful, long-term partnerships with clients to help them achieve their financial and lifestyle goals. The company prides itself on being upfront, open, and committed to its clients, ensuring their assets are protected and grown towards financial independence. NFP operates as a Corporate Authorised Representative of NFP Group Pty Ltd, which is an Australian Financial Services Licensee.

Services offered by National Financial Planners include:

- Tailored Financial Services: NFP has developed a range of services designed to meet the financial needs of clients at different life stages. These services are flexible to cater to the unique requirements of each client.

- Special Offers: NFP provides offers such as up to 15% off the first year's premiums for Life & Disability Insurance.

- Client-Centric Approach: The company values the quality and professional standing that comes from client satisfaction and testimonials.

Phone: 03 9504 3879

Email: enquiry@nfp.com.au

Website: https://nfp.com.au/

Summerhill Financial Services

Summerhill Financial Services, likened to a personal trainer for finances, is committed to providing discipline, structure, and control to help clients make the most of their income and enjoy their prefered lifestyle.

The company, led by financial advisor Alex Perini, supports clients from various backgrounds in understanding and achieving their personal and lifestyle goals. Summerhill Financial Services emphasises education, transparency, and tailored strategies to increase clients' financial well-being and peace of mind, allowing them to focus on family, lifestyle, and career.

Services offered by Summerhill Financial Services include:

- Savings Boost: Guidance on boosting savings for various purposes through regular contributions.

- Investments: Developing the right investment strategies and contribution levels to meet future goals.

- Lifestyle Funding: Creating portfolios to fund lifestyles that include travel, new experiences, and good food.

Email: mail@summerhillfs.com.au

Website: https://www.summerhillfs.com.au/

Diversified Financial Planners

Diversified Financial Planners Pty Ltd is a financial services firm that focuses on helping clients plan for their future and reach retirement savings goals. They specialize in establishing, growing, and protecting wealth, with a particular emphasis on making the most of superannuation. The company is known for its expertise in various core financial services and is committed to providing tailored solutions to meet the unique needs of each client.

Services offered by Diversified Financial Planners include:

- Superannuation: Expertise in managing superannuation funds, designed to reward long-term investment.

- Retirement Planning: Strategies for investing in superannuation to benefit from tax efficiencies and compounding returns.

- Self-Managed Superannuation Funds (SMSFs): Offering greater control, flexibility, and choice in superannuation management.

- Wealth Protection: Providing insurance solutions as a foundation for financial plans.

- Investments: Guidance on investment strategies to fund longer retirements due to increased life expectancy.

- Home Loans: Assistance with navigating the housing market and securing home loans.

Phone: 03 9770 6499

Email: mail@diversifiedfp.com.au

Website: https://diversifiedfp.com.au/

Affinity Private Advisors

Affinity Private Advisors is a financial planning firm based in Melbourne, Australia, focused on helping clients achieve true wealth, which they define as living a rich and meaningful life. The firm emphasises the importance of realising one's greatest potential, achieving professional goals, positively influencing the world, and enjoying life with loved ones. Affinity Private Advisors offers a range of financial services aimed at building true wealth for their clients.

Services offered by Affinity Private Advisors include:

- Investment & Portfolio Management: Tailored strategies for managing investments and portfolios.

- Retirement and Income Strategies: Planning for a secure and comfortable retirement.

- Personal & Business Insurance: Providing insurance solutions for both personal and business needs.

- Estate and Succession Planning: Ensuring a smooth transition of assets and business interests.

- Philanthropy – Charitable Giving: Guidance on making impactful charitable contributions.

- Residential and Commercial Finance: Assistance with financing for both residential and commercial properties.

Phone: 03 8488 6394

Email: enquiries@affinityprivate.com.au

Website: https://affinityprivate.com.au/

While managing a client's portfolio may be a straightforward endeavour, managing their expectations can be harder. Many clients have unrealistic expectations regarding investment returns and interest rates. For starters, clients are often not financial professionals.

What specific assets must the firm obtain to achieve its goals? How much additional financing will the firm need to acquire these assets?

It might be quite surprising that the most asked question is "what is my ip". A little over 3 million people ask this question every month on Google, just one variation of the question.

Financial advisors provide various services, such as investment management and financial planning. Unfortunately, when an advisor takes possession of your money (also known as taking "custody") for investment management, there's an opportunity to steal those funds.

Industry studies estimate that professional financial advice can add 1.5% and 4% to portfolio returns over the long term, depending on the period and how returns are calculated. A 1-on-1 relationship with an advisor is not just about money management.